Today’s vendors now offer specific implant technology that can no longer be categorized into a single specific implant classification. For example, a cervical spacer used to be just a cervical spacer. Today, that cervical spacer may be cleared for use by the FDA and classified as either a:

- Cervical Spacer or Cage (requiring supplemental fixation)

- Cervical Stand-Alone Device – Cage

The two constructs above should have the same price; however, the cervical stand-alone assembly (Cage + Plate + Screws) pricing will be higher. Ergo, negotiating contracts and pricing for complex implants such as these can be challenging.

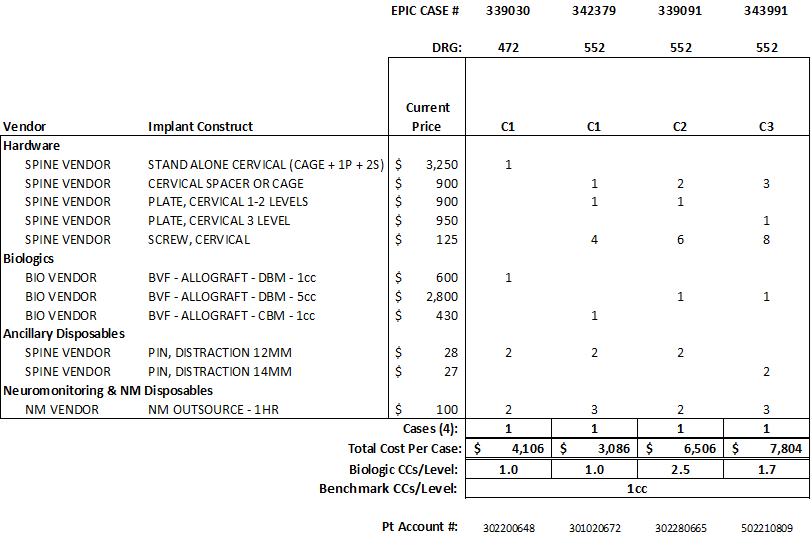

Below is an example of a surgeon profile for anterior cervical fusions:

Where do you start?

Any cervical spacer or cage that is part of a stand-alone assembly should be priced as a standard cervical cage.

In this example, we will focus on cervical stand-alone devices.

Review your current pricing

- Calculate your average cost for a cervical spacer and a stand-alone cervical assembled device

- Determine which vendors have the biggest discrepancies from the average cost and perform a focused audit of that vendor

Research your technology: Current vendor websites and literature may not present the spacer as having multiple uses

- Request the surgical technique guide from the vendor

- Review the surgical technique guide to assist in understanding how the technology is assembled

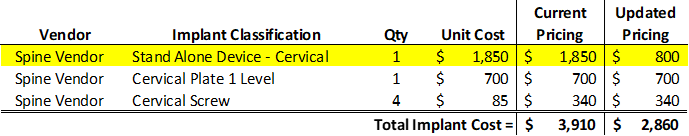

In Example 1 below, the vendor classified the cervical spacer as a stand-alone spacer at a cost of $1850. This hospital’s average price for a cervical spacer is $800. After researching this technology, the spacer may be used a cervical spacer or as a component in a stand-alone cervical assembly. In this case, the device was utilized as a traditional cervical spacer at a cost of more than double the hospital’s average price for like technology. If the cervical spacer had been classified and priced correctly, the total cost of the hardware would have been $2,860 vs $3,910 – a difference of over $1000.

Example 1

How do you fix the pricing and classification issue?

- Review/research the vendor’s technology for cervical spacers & cervical stand-alone devices

- Determine pricing and classification for the assembled stand-alone device and cervical spacers and update the vendor’s pricing file.

- Prepare an addendum to the current agreement

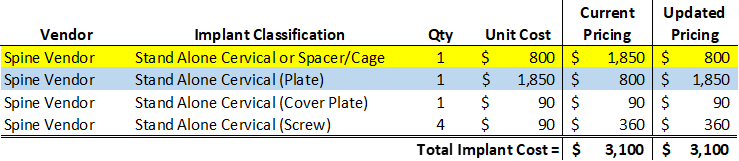

In Example 2 below, this vendor’s stand-alone cervical device consists of a cervical spacer, plate, cover plate, and 4 screws. The hospital’s average cost for a cervical stand-alone assembly is $3100. The below example prices the cervical spacer at $800 (the hospital’s average price) and prices the remaining implants to total $3100. The hospital swapped the price of the spacer/cage with the plate – the vendor remains at the original agreed upon price for the cervical stand-alone, but the hospital is able to adjust the cervical spacer price to their current average price of $800.

Example 2

This was a less complicated example; however, some vendors have stand-alone devices with multi-hole plates. For example, one spine vendor has 2-hole, 3-hole, and 4-hole plates used in their cervical stand-alone assemblies; therefore, the assembly consists of a cervical spacer, one of the aforementioned plates, and 2, 3, or 4 screws. How do you price this assembly? The assembled price would include the spacer, a 4-hole plate, and 4 screws – similar to the Example #2 table above at the average price of $3100. If the 2-hole or 3-hole plates were used in the assembly, then the cost of the plates would be $2920 and $3010, respectively.

Now that you have this all worked out, some vendors have cervical spacers with built-in plates that can only be used in a stand-along assembly. Again, it pays to research and know your technologies. Is it realistic to know all of them? No, but on a case-by-case basis, you and your team can target more expensive vendor technologies and make a positive impact on your bottom-line.

For more information, please contact Kim Nilsson at KNilsson@AskPHC.com or 980-721-2637, or John Ossowski at JOssowski@AskPHC.com or 801-209-3304 or Andrew Arreola at AArreola@AskPHC.com or 480-510-7940.