Interventional Neuroradiology: A Specialty on the Rise

Background

With increases in technology and breakthroughs in the healthcare field, new and innovative medical specialties and/or sub-specialties are gaining prominence. Amongst those specialties is the field of interventional neuroradiology – a marriage of radiology, neurology, and neurosurgery. As discussed in the following sections, we examine the origins and purpose of the specialty as well as key trends and compensation considerations as this field is seemingly here to stay.

What is Interventional Neuroradiology?

In recent years, hospitals have seen an increased use in Interventional Neuroradiology, also referred to as “INR”. As defined by Columbia Radiology, INR is “dedicated to the development and application of imaging to guide minimally invasive techniques utilized in diagnosis and treatment of a wide variety of conditions” (Center, n.d.). Through cross-sectional and three-dimensional imaging, INR has greatly improved head, neck, brain and spine diagnosis and outcomes. This field has continued to grow rapidly within the past decade due to the success of the diagnoses and treatments. For example, just 15 years ago, patients with many medical conditions that could not be effectively addressed are now – through INR – able to receive successful treatment (Amon Y Liu, n.d.).

How Does INR Compare to Endovascular Neurosurgery?

INR is closely related to Endovascular Neurosurgery (ENS) in many ways. Healthcare providers experience similar training and residency for these specialties. For example, both specialties require training in radiology as well as neurosurgery or neurology (Deepak Sudheendra, Marianne Fraser, & Raymond Kent Turley, n.d.). To illustrate this point, consider the definitions and descriptions of these two specialties:

- Endovascular neurosurgery is a subspecialty within neurosurgery that uses catheters and radiology to diagnose and treat various conditions and diseases the central nervous system; whereas,

- Interventional neuroradiology is a subspecialty within radiology that also uses catheters and radiology to diagnose and treat neurological conditions and diseases. (Endovascualr Neurosurgery and Interventional Neuroradiology, n.d.)

So closely related are these two disciplines that physicians who specialize in ENS require training in both neurosurgery and radiology. After completing a neurosurgery residency, these providers complete a fellowship program in endovascular neurosurgery. Similarly, physicians who specialize in INR also require training in both radiology and neurology or neurosurgery. After completing a radiology residency, these providers complete a fellowship in INR.

Upon completion of these fellowships, INR and ENS physicians are able to perform many of the same procedures. Some of these procedures include thrombolytic therapy, blood clot retrieval, minimally invasive spine surgery, and cerebral angiography (Deepak Sudheendra, Marianne Fraser, & Raymond Kent Turley, n.d.). As with many areas in the field of medicine, there has recently been an increase in technological advancements for these procedures. These once complex procedures can now be carried out through minimally invasive techniques (Emerging Growth for Interventional Neuroradiology Market by 2019-2025, 2019). These technological progressions and advancements in available treatments for this specialty allow quicker and less intense procedures as well as faster patient recovery times.

Demand and Recruiting Issues

Age-Related Factors

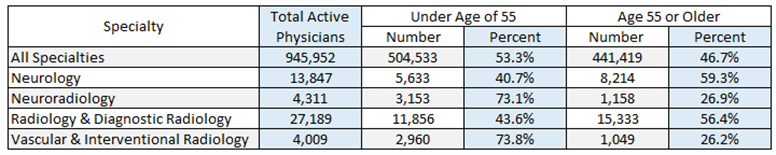

Like other specialties, many physicians within this field are over the age of 55 and will be retiring in the coming years. According to a study done by Association of American Medical Colleges (AAMC), across all specialties, 47% of physicians are over 55 years old (Physician Specialty Data Report, 2021). The following table breaks out active physicians by related specialty and age.

With many physicians nearing retirement age, the demand for this specialty, among others, has reached an all-time high. According to a study done by the United States Census Bureau, the country’s elderly population has grown nearly five times faster over the last 100 years. In 1920, about 4.7% of the total population were over the age of 65; however, today, 17% of the total population is over the age of 65 (Caplan, 2023). With this drastic spike in the number of elderly patients comes an increase in medical needs and physician demand. In particular, stroke is one of the leading causes of long-term disability within the United States and INR allows for quicker diagnosis and treatment of this disability. Because of positive results such as those associated with stroke intervention and recovery, INR will likely continue to be an area of heightened demand among hospitals and patients.

Growth Trends

Not only is demand for INR physician services expected to grow into the future, but, over the last decade, this demand has already grown in a rapid fashion, with a compound annual growth rate of 8.97% (Interventional Neurology Devices Market Size & Share Analysis – Growth Trends & Forecasts (2023-2028), n.d.). With advancements in technology (i.e., developments of different microcatheters, embolic agents, guidewires, high resolution imaging tools and therapeutic techniques) as well as an increase in minimally invasive procedures, the demand for these providers is not anticipated to slow down in the near future (Emerging Growth for Interventional Neuroradiology Market by 2019-2025, 2019).

In fact, these types of developments have caused INR-related treatments to now serve as the standard-of-care for patients with neurovascular disorders. With greater technology, physicians are able to detect the diagnosis at an early stage and provide treatment to patients before chronic diseases worsen. This ability to provide diagnosis and treatment at early stages have not only caused an increase in demand for INR physicians but also for the appropriate systems and products. Despite this fact, many hospitals are struggling to keep up with the new products as technological advancements continue to arise. Radiological instruments such as MRI scanners, X-ray systems and CT scanners come at a very high cost, a factor which has caused restraint for many hospital markets, specifically those in emerging countries (Geographic Scope and Forecast, 2022).

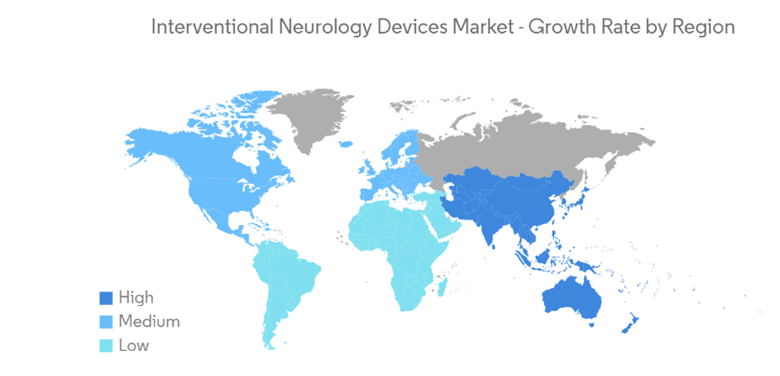

North America has experienced an increasing burden of neurological diseases such as Alzheimer’s and Parkinson disease. As reported by the Brain Injury Association of America, roughly 3.5 million Americans annually suffer the effects of traumatic brain injuries (TBIs), 2.8 million individuals sustain TBIs annually, and 280,000 people are hospitalized for these brain injuries (Interventional Neurology Devices Market Size & Share Analysis – Growth Trends & Forecasts (2023-2028), n.d.). As the prevalence of neurological injuries, conditions, and diseases have increased, the demand for INR specialists and radiological devices has simultaneously grown. The following map shows the interventional neurology device market growth rate by region.

This map illustrates the projected growth trends in INR-related devices from 2023 to 2028. As the forecasts show, much of the world will see a significant increase in these types of devices and INR specialists will be required to make their use possible.

How Hospitals are Adapting to the Increase in Demand

Increased Call Coverage

Within the last number of years, the healthcare industry has experienced an increase in unrestricted (i.e., beeper) on-call INR coverage services. In recent analyses completed by Pinnacle Healthcare Consulting (PHC), several notable observations have emerged. Amongst the novel ways that hospitals are tackling the increased demand for these services are on-call coverage arrangements that engage INR physicians to:

- Provide availability on an on-call basis while advanced practice providers (APPs) are performing patient care during the day[1];

- Provide call coverage services on a “combined” basis with neurosurgery physicians[2];

- Provide call coverage services on a “concurrent” basis across more than one facility[3]; and,

- Provide call coverage on a primary and/or back-up basis to ensure continuous INR availability.

Based on market benchmark data specific to unrestricted coverage, INR physicians have earned between approximately $1000 and $2,400 per 24-hour shift for coverage services. This market data reflects beeper coverage only and may not fully address various factors affecting the “burden” of coverage such as excessively high volumes, market dynamics, combined/concurrent coverage, etc. When combining market data with calculations also performed under a cost approach for fair market value analyses, the resulting 24-hour coverage costs can exceed $3,000 per day. Nonetheless, these results ensure adequate physician availability for 24-hour period and remain less than costs associated with a restricted model. As the INR specialty continues to increase in prominence, additional data will continue to inform the direction of provider compensation in this market.

AI Implementation

As previously discussed, there have been significant advancements in the medical field over the last decade in available technology. With the implementation of certain artificial intelligence (AI) tools, industry experts assert that patients will receive better and faster treatments. For example, AI has the ability to detect and diagnose within the emergency department (ED) and immediately send images to physicians on their mobile devices. Additionally, AI can evaluate the appropriateness of imaging (i.e., suggest protocols for each exam, position patients in the scanner, correct scan range and image review and analysis), schedule patients, election of examination protocols and improve the radiologists reporting workflow (Cowen, 2023). The implementation of AI provides an exceptional number of benefits for both the physician as well as the patient.

Likewise, following the onset of the COVID-19 pandemic, many hospitals experienced staffing shortages. During this time, many hospitals turned to telemedicine to help with the shortage issues. While virtual clinics are uncommon for patients requiring INR treatment (in part because of its interventional nature), there has been growth in the implementation of virtual follow-up clinics for this specialty. According to a study related to patient stratification, these virtual follow up clinics are more efficient and are preferred by patients (Lun, et al., 2020). Likewise, AI will help reduce the burden on wait times and negative outcomes by expediting treatment. Through AI, there is anticipated to be less hospitalization, less beds occupied, and less physical support from the physicians (Yaniv). In fact, it has been proven that AI produces images 30% faster, with higher quality resolution and the number of patients scanned per day which has increased – according to one source – from 20-25 to 30-35 (Cowen, 2023). The combination of AI implementation and virtual follow up clinics is expected to reduce required face-to-face time for physicians and patients – a factor which is expected to lead to an increased number of patients seen per day and to lessen the burden of staffing shortages.

Compensation

Determining Compensation for INR

There are various factors that inform compensation levels for interventional neuroradiologists. When determining compensation, many variables must be considered, including:

- The location of the hospital/practice

- The type of practice

- The type of services

- Incentives and achievement of quality metrics

- Demand of the specialty

- Physician experience in the field

- Provider supply

- Volume and acuity

- Trauma designation

While this list is not exhaustive, it illustrates the many factors that may have an effect on compensation for INR physicians. Generally speaking, radiologists are one of the most highly compensated physician specialties. Because interventional neuroradiologists require additional education (i.e., bachelor’s degree, medical degree, radiology medical residency and neurointerventional radiology fellowship), these physicians are paid at a premium. According to an article written by Barbara Bean-Mellinger, the average annual compensation for INR physicians in 2019 was $573,499 (Bean-Mellinger, 2020).

In addition to general industry information, provider compensation benchmarks illustrate various data points from multiple, objective surveys. However, it should be noted that when using these survey resources, provider compensation professionals should consider the requirements/services under a subject agreement and numerous specialties and/or sub-specialties which may be representative of the services. For example, PHC noted on a recent INR-related assessment that various benchmark compensation resources may refer to the specialty as interventional neuroradiology (i.e., INR), neuro-endovascular surgery, neurological radiology, endovascular neurology, interventional neurology, and/or diagnostic-neurointerventional radiology. With the increase in demand for these services and providers, benchmark compensation data will likely continue to evolve and become more refined. For now, organizations should carefully document their need, processes used, services provided, and any qualitative factors that may have a material effect on provider compensation.

Conclusion

To conclude, the INR specialty has seen significant growth in recent years and is projected to continue to grow at a rapid speed. Factors such as physicians nearing retirement with a simultaneous increase in demand for this specialty amongst an aging population, it is crucial that hospitals and practices find a way to adapt. With the implementation of AI and use of new technological advances, both physicians and patients will greatly benefit.

For more information, please contact Allison Carty (ACarty@AskPHC.com) or Claire Falcone (CFalcone@AskPHC.com).

[1] Under this type of coverage model, while the physician may have to come into the hospital to perform consultations and procedures, their on-site time is much less than without the use of on-site APPs. The volume of consultations and procedures (i.e., number of calls received during a shift) will dictate how much time the INR physician must be in the hospital while on-call.

[2] Under this type of coverage model, the on-call physician is required to provide simultaneous availability for both neurosurgery patients and INR patients (as clinically appropriate).

[3] Under this type of coverage model, the on-call physician is required to provide simultaneous availability for INR patients at more than one hospital or facility (as clinically and operationally appropriate).