In Q2 2025, HCA Healthcare (HCA), Tenet Healthcare (THC), Community Health Systems (CHS), and Universal Health Services (UHS) reported solid year-over-year performance, each navigating operational challenges, shifting service mix, and targeted growth strategies. Below is a condensed analysis of their performance, and full-year outlook, as viewed through the lens of Pinnacle Healthcare Consulting.

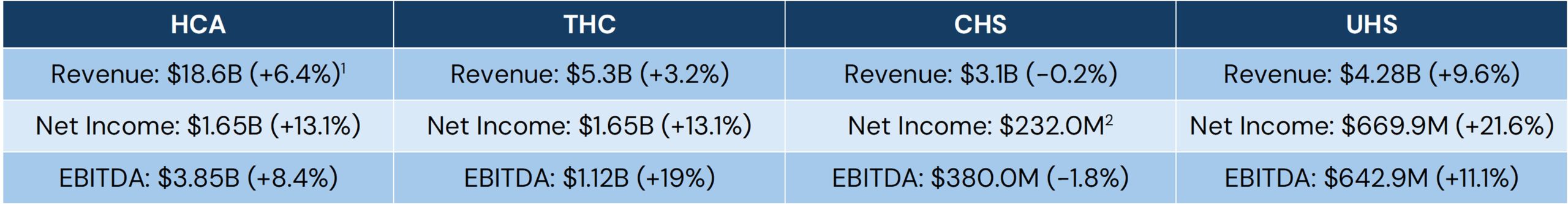

Key Q2 Financial Metrics

In Q2 2025, hospital operators saw steady revenue and earnings growth overall, though performance varied by company. HCA and UHS led in both revenue expansion and profit gains, supported by volume growth, favorable payer mix, and supplemental Medicaid payments. THC also delivered solid results, with strong EBITDA growth driven by higher-acuity cases and ambulatory services. CHS lagged in revenue growth but improved profitability through payment programs and cost controls.

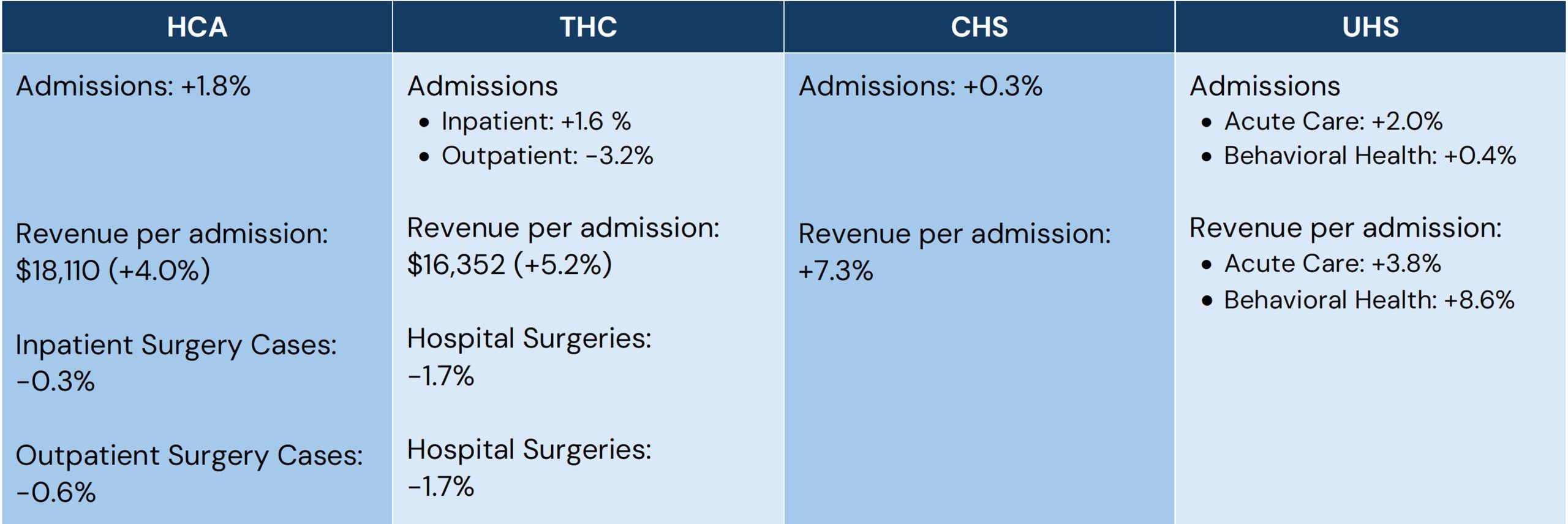

Segment & Service Line Performance

For HCA, inpatient and emergency room activity rose, while surgeries softened slightly. Medicaid policy changes under the Big Beautiful Bill are expected to have minimal impact due to the company’s large presence in non-expansion states, and anticipated coverage losses are expected to be offset by its financial resilience measures.

THC also saw inpatient volumes improve and revenue per admission rise, driven by higher acuity and favorable payer dynamics. While outpatient visits and surgeries fell, its USPI ambulatory segment posted strong same-facility growth, maintained high margins, and expanded through acquisitions and new facilities. Hospital operations achieved greater profitability through higher acuity, payer mix optimization, and cost control, with supplemental Medicaid payments providing an additional boost.

CHS delivered modest inpatient and adjusted admissions growth, with revenue per admission increasing due to rate improvements and state-directed Medicaid payments. However, surgical and ER volumes declined, and labor costs rose with physician hiring. Strategic actions included selling a stake in Cedar Park Medical Center and refinancing $700 million in debt, while further state payment benefits are expected later in the year.

UHS achieved growth in both acute care and behavioral health, supported by higher patient days and improved revenue per admission. Supplemental Medicaid payments, particularly from Tennessee’s program, boosted earnings despite start-up losses from a new hospital in Washington, D.C. Behavioral health expansion remains a priority, with new facilities opened or planned across several states.

The following shows how these factors shaped segment-level performance for both companies:

Pinnacle sees valuation potential depending on each company’s ability to sustain margins and keep revenue streams predictable. UHS’s mix of acute care and behavioral health offers stability, with behavioral health providing growth that is less tied to cyclical hospital admissions that often draws stronger valuations. THC’s ambulatory network remains a key driver due to its scalability, solid margins, and broad payer reach. HCA’s inpatient and ER performance supports steady cash flow, though slower surgical growth could be limited unless efficiency improves or higher-margin specialties expand. CHS’s rising admissions and rates are encouraging, but its reliance on rate hikes, Medicaid supplements, and higher physician costs means valuation gains will depend on controlling expenses while growing sustainably.

Full Year Outlook

HCA forecasts revenue in the mid-$70 billion range, net income above $6 billion, and adjusted EBITDA near the mid-$15 billion range. Admissions are projected to grow modestly, reflecting steady volumes across payer categories.

THC forecasts revenue of just over $21 billion and consolidated adjusted EBITDA in the mid-$4 billion range, with ambulatory services remaining a key growth driver and USPI contributing about $2 billion in EBITDA.

CHS projects net revenue of $12.3-$12.6 billion and adjusted EBITDA of $1.45-$1.55 billion for the year. State-directed payment programs are expected to contribute in the back half of 2025, with no direct impact from upcoming Medicaid policy changes until 2027.

UHS forecasts net revenue between $17.1-$17.3 billion and adjusted EBITDA of $2.5-$2.5 billion. Growth will continue to be driven by behavioral health expansion, operational efficiencies, and payer mix optimization.

From Pinnacle’s perspective, valuation paths across the hospital sector will depend on the ability to protect margins while navigating labor cost pressures, shifts in payer mix, and evolving regulatory requirements. Operators that can scale higher-margin service lines, improve efficiency, and reduce reliance on supplemental payments are best positioned to command stronger valuation multiples. Long-term upside will be tied to demonstrating sustainable growth that is less sensitive to policy changes and executing operational improvements in a challenging environment.

1 All percent changes represent Year-Over-Year growth unless otherwise noted

2 An increase from a loss of $13.0 million in 2024