On August 5th, both Fresenius Medical Care and DaVita unveiled their Q2 2025 results, marked by strong financials, operational headwinds, and strategic repositioning. Below is a condensed analysis of their performance, and full-year outlook, as viewed through the lens of Pinnacle Healthcare Consulting.

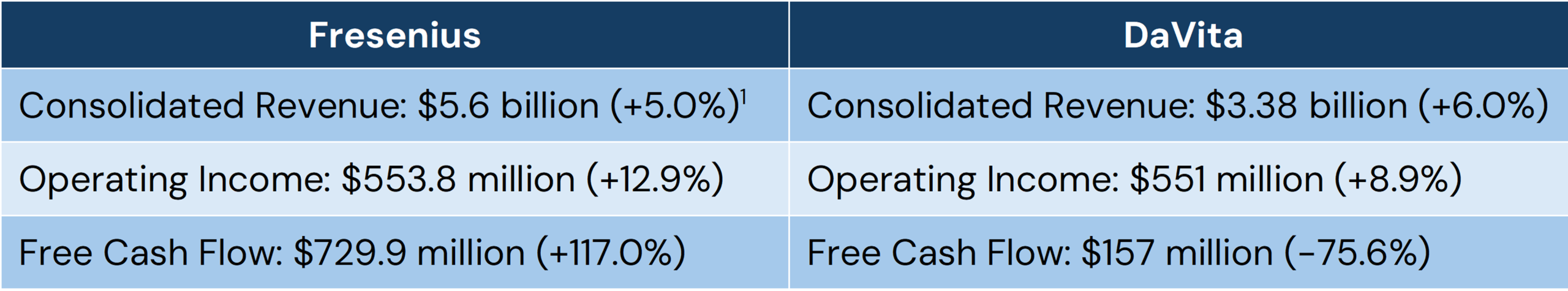

Key Q2 Financial Metrics

Both Fresenius and DaVita posting solid Q2 2025 revenue and operating income growth, but with very different cash flow trends. Fresenius’s jump in free cash flow points to stronger operations and more financial flexibility, while DaVita’s steep drop suggests ongoing challenges that could hold back short-term investor confidence. Below is a side-by-side comparison of key financial metrics for both dialysis leaders.

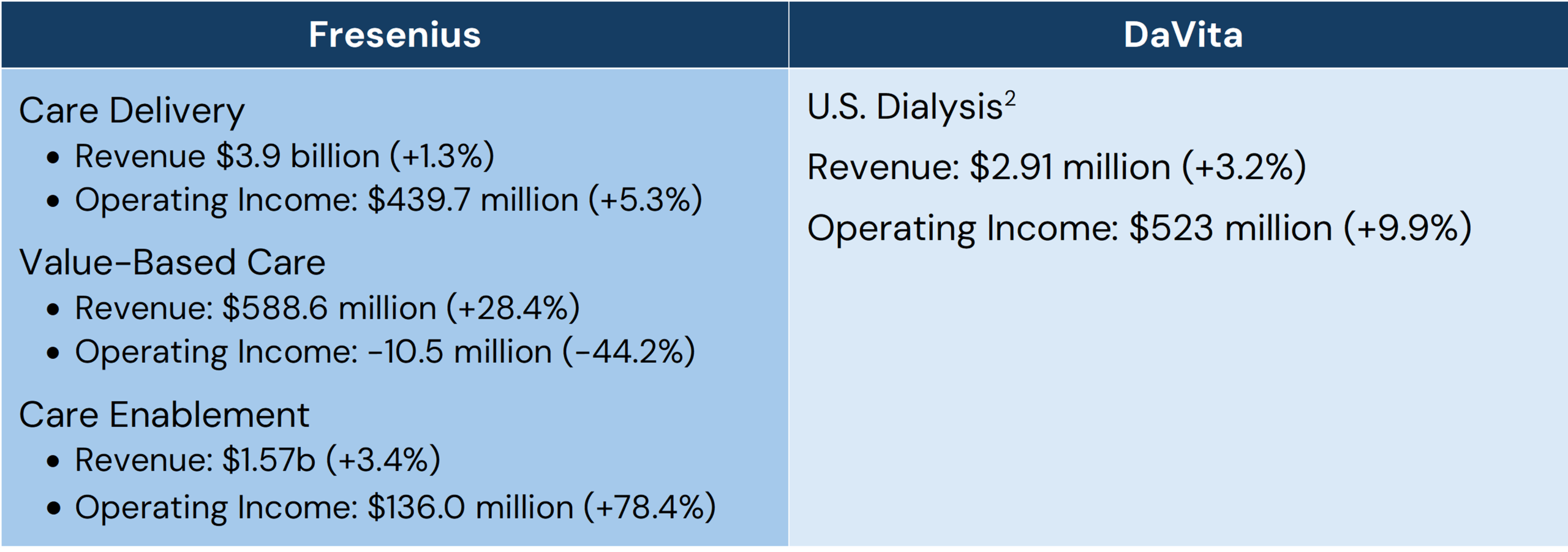

Segment & Service Line Performance

Fresenius’ Care Delivery segment saw growth, supported by favorable rate effects but negatively impacted by seasonal flu impacts and higher labor costs. Its Value-Based Care segment posted strong revenue growth from contract expansion and improved reporting but faced unfavorable savings rates and inflation. Care Enablement was a standout, boosted by solid volume, positive pricing, and the FDA clearance of its updated 5008x dialysis system.

The company’s strength in Care Enablement signals strong adaptability and positions the company to command higher investor confidence. From Pinnacle’s perspective, this performance could support an upward trend in valuation, since investors tend to reward companies that can expand profitably in high-growth, defensible markets while also showing the ability to navigate and adapt to shifting policy and reimbursement landscapes.

Meanwhile, DaVita’s U.S. Dialysis business achieved revenue and income growth despite a cybersecurity incident in Q2 that disrupted operations and increased mistreatment rates. Gains were driven by improved labor productivity and higher revenue per treatment, even as dispensing volumes for phosphate binders were lower than expected.

For DaVita, Pinnacle sees resilience in the ability to grow despite significant operational headwinds, but also flags that repeated disruptions, especially from cybersecurity incidents, may affect investor sentiment. The firm believes that improving system resilience and maintaining efficiency gains will be critical to sustaining valuation.

The following shows how these factors shaped segment-level performance for both companies:

Full Year Outlook

Fresenius expects revenue to grow in the positive to low single-digit range and is targeting an operating income margin of 11-12%, driven continued efficiency improvements, recovery in patient volumes, and strategic focus on higher-value segments like Care Enablement and Value-Based Care.

DaVita, meanwhile, anticipates an adjusted operating income between $2.01 and $2.16 billion. However, treatment volume is expected to decline 75 to 100 basis points year-over-year, primarily due to lingering effects from the Q2 cybersecurity incident and elevated mistreatment rates. Despite this, the company expects revenue per treatment to grow by 4.5-5.5%.

From Pinnacle’s perspective, Fresenius enters the next quarter with operational momentum in technology-enabled services and efficiency gains, which could enhance its competitive position if paired with improvements in value-based care. DaVita’s ability to recover from operational setbacks while sustaining productivity and pricing strength indicates underlying stability, but long-term valuation gains will depend on its success in mitigating recurring risks and restoring volume growth. For both, execution on strategic initiatives, particularly in higher-value care delivery and technology integration, will be pivotal in maintaining investor confidence and driving sustainable performance.

1 All percent changes represent Year-Over-Year growth unless otherwise noted

2 Growth represents change from first to second quarter 2025