Introduction

On July 16, CMS (Centers for Medicare & Medicaid Services) released their Fee Schedule Proposed Rule with updates and revisions to the reimbursement rates for services provided under Medicare. The proposal includes several factors that will undoubtedly have a financial impact to providers and healthcare organizations.

Payment Updates

The proposed rule includes updates to the payment rates for services and procedures provided by healthcare providers under Medicare Part B and will have a financial impact on healthcare providers, affecting their revenue depending on codes utilized, volume, and the place of service where care is provided.

- The proposed rule incorporates a 2.50% overall update along with other adjustments for budget neutrality and APM incentives.

- For non-AAPM participants, the proposed conversion factor payment rate per Relative Value Unit (RVU) for those not participating in an AAPM is $33.42, a 3.32% increase from 2025.

- The proposed conversion factor for those in qualifying AAPMs is $33.59, a 3.83% increase from 2025.

CMS is also proposing to change how it calculates indirect practice expense (PE) in a way that should benefit physicians who work outside of “facility” settings (e.g., hospitals, ambulatory surgical centers, or skilled nursing facilities) with the assumption that facility-based clinicians have lower indirect costs than those in non-facility settings. This change will likely result in lower overall reimbursement for clinicians working in facility settings. Facility-based payments to physicians will decrease overall by -7% while non-facility-based payment to physicians is expected to increase by +4%. The results to individual physicians and specialties are proposed to be substantial.

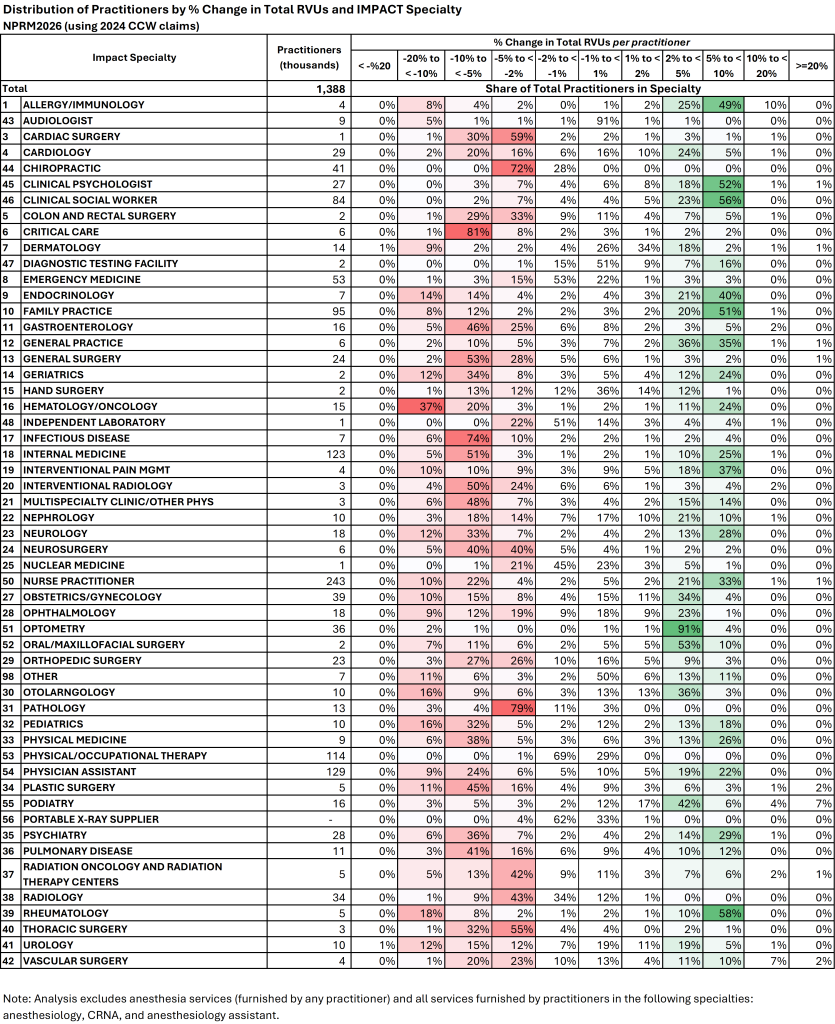

Below is a table of the impact by specialty on Total RVUs (TRVU) by specialty[1]. Total RVUs are multiplied by the conversion factor to determine reimbursement, so this table provides insight into which specialties will likely see reimbursement increases and decreases.

Notable specialties with a high likelihood of reductions to total RVU production include:

- Cardiac Surgery

- Thoracic Surgery

- Chiropractic providers

- Pulmonary Disease

- Plastic Surgery

- Pathology

- Infectious Disease

- Critical Care

- Colon and Rectal Surgery

- Orthopedic Surgery

- Hematology/Oncology

Specialties with a high likelihood of increases to total production include:

- Rheumatology

- Psychiatry

- Family Practice

- General Practice

- Endocrinology

- Allergy/Immunology

- Clinical Psychology

- Clinical Social Workers

- Interventional Pain Management

Other Compensation Considerations

There have been a number of changes to Work RVUs (WRVU) associated with certain CPT codes. This is notable for providers who have compensation plans that are tied to Work RVU production. Linked here is a table of the top 200 codes utilized by Medicare providers (by Total Charges)[2]. Note that approximately half of these codes have a reduction in Work RVU value in 2026, while only a handful have been assigned a higher WRVU value than 2025. Also notable is the reduction in Facility reimbursement and the corresponding changes (increases) in Non-Facility reimbursement.

Impact on Rural Providers

For rural providers or those serving underserved populations, the proposed rule may include provisions for adjusting payments to ensure access to care in these areas, which may have a positive financial impact for these practices. The Rural Health Transformation Program is part of a reconciliation package and allocates $50 billion over five years (starting in fiscal year 2026) for state grants to improve healthcare access and outcomes in rural areas.

Medicare Drug Pricing

The Centers for Medicare & Medicaid Services (CMS) will redesign the Medicare Part D Drug benefit. Initially, 10 drugs will be subject to price negotiation with prices capped based on current Medicare plan prices and discounts and minimum discounts based on the drug’s age. Under the selected drug subsidy program created by the IRA, Part D sponsors will receive a government subsidy for selected drugs equal to 10% of the drug’s negotiated price.

The CY 2026 annual out-of-pocket (OOP) threshold of $2,100, which is the original 2025 out-of-pocket cap of $2,000, adjusted based on the annual percentage increase in average expenditures for covered Part D drugs in the U.S. for Part D eligible individuals in the previous year (API).

Home Health Prospective Payment System (HH PPS)

The 2026 proposed rule for home health includes a 6.4% payment cut, totaling $1.135 billion, according to the American Speech-Language-Hearing Association. This reduction is a combination of permanent and temporary payment adjustments aimed at aligning payments with costs under the Patient Driven Groupings Model (PDGM).

Summary

While CMS is attempting to make some improvements to provider payments, due to budget neutrality considerations, the overall result appears to be a reshuffling of the deck, with some specialties benefiting while others will sustain reductions in reimbursement.

If you have questions or would like to discuss ways to improve your contracting and revenue cycle processes, or to do an impact analysis of compensation and revenue for your organization, please contact our Strategy & Value-Based Care team at Pinnacle Healthcare Consulting.

[1] https://www.cms.gov/files/zip/cy-2026-pfs-proposed-rule-specialty-impacts-practitioner.zip

[2] Information derived from CMS data and analyzed by Pinnacle.