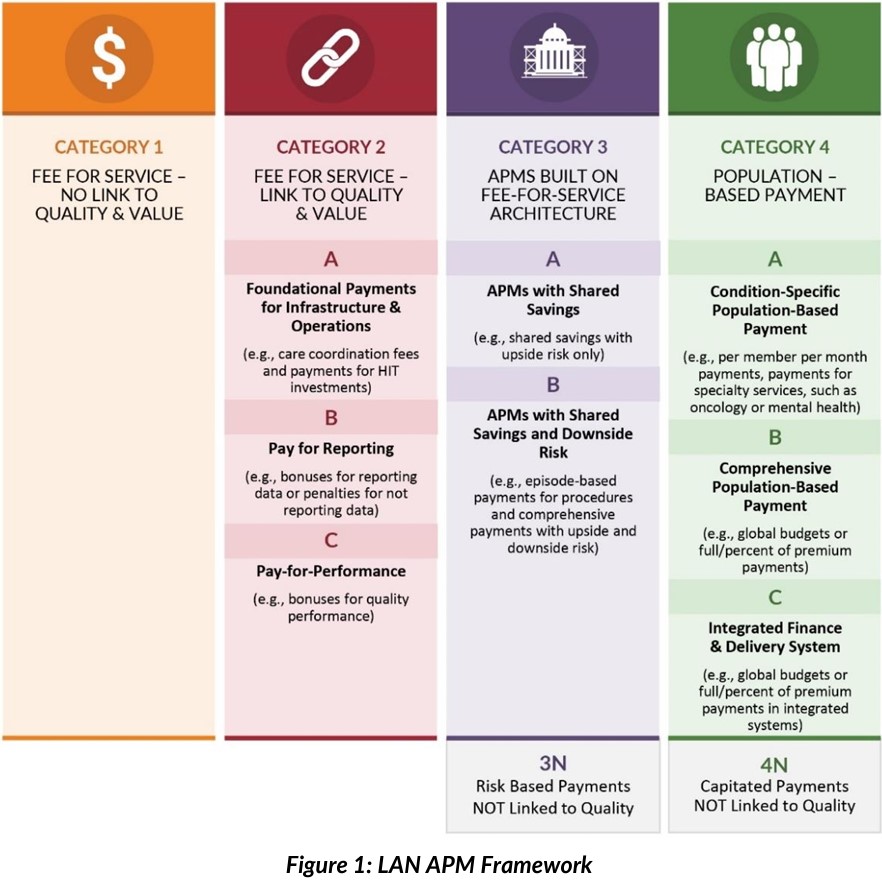

In a time where healthcare costs continue to rise, there is a diverse range of payment models in use, ranging from traditional fee-for-service to global capitated payment, to stunt the growth in costs. The Health Care Payment Learning & Action Network (HCP-LAN) has identified four main categories of payment (as shown in Table 1)[1]. The primary objective of promoting value-based payment is to shift as many providers and as much revenue as feasible into the third and fourth categories.

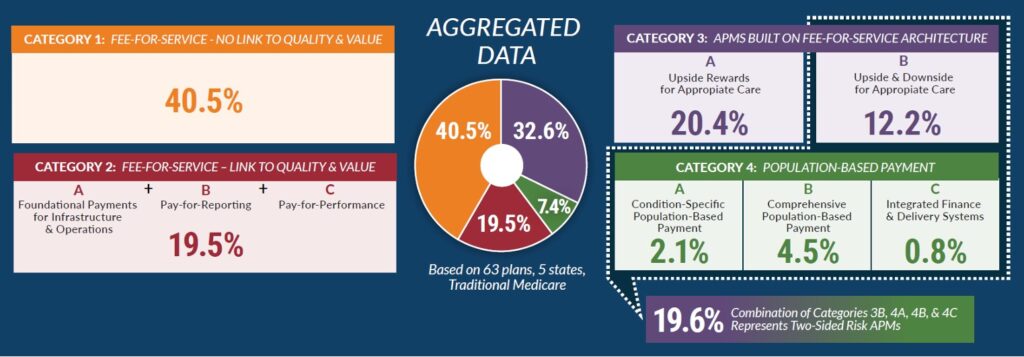

The 2022 Alternative Payment Model (APM) results from the HCP-LAN, resulted in the following:

Shared savings contracts have emerged as a promising approach to promote cost-effective and high-quality care delivery. These contracts incentivize healthcare providers to achieve cost savings while improving patient coordination and outcomes.

A shared savings contract is an agreement between healthcare payers and providers that aims to reduce healthcare costs by sharing the financial benefits resulting from cost savings. Providers are rewarded when they achieve cost reduction targets through smarter spending while maintaining quality benchmarks. This innovative payment model fosters collaboration between payers and providers, aligning their interests towards cost-efficient care delivery. Shared savings arrangements can range from private commercial insurance to working with the government/Medicare.

Different Shared Savings Arrangements

Shared savings contracts encompass a range of diverse structures, allowing healthcare providers to choose the arrangement that best suits their organization’s goals and capabilities. One option is to enter into commercial contracts with private payers which involves negotiations and agreements directly with insurance companies. Another avenue for participation is through the Medicare Shared Savings Program (MSSP), a government initiative that aims to promote accountable care and cost savings within the Medicare population. MSSP provides a regulatory framework and support for providers to transition to value-based care and engage in collaborative efforts with other healthcare stakeholders. Bundled payment arrangements are another type of shared savings contract. In this model, providers are reimbursed a fixed payment for an entire episode of care, encompassing all services and treatments related to a specific condition or procedure. Bundled payments encourage coordinated and efficient care delivery across different healthcare providers involved in the patient’s journey with the goal of reducing costs and improving outcomes.

When considering participation in a shared savings contract, it is essential to carefully evaluate the requirements and criteria of each arrangement. Commercial contracts may involve different payment methodologies and quality benchmarks while MSSP requires adherence to specific program guidelines and reporting requirements. Bundled payment arrangements require collaboration and coordination with other providers within the episode of care. By evaluating the alignment of each arrangement with organizational goals, capabilities, and resources, providers can make informed decisions about which shared savings contract is most suitable for their practice or institution.

Ultimately, participating in a shared savings contract offers an opportunity for healthcare providers to enhance care quality, reduce costs, and improve patient outcomes. By selecting the right arrangement and understanding its unique requirements, providers can actively contribute to the transformation of healthcare delivery towards a more value-based and patient-centered system.

Components of Shared Savings Contracts

Shared savings contracts typically involve the following key components:

a) Attribution: Attribution rules play a crucial role in shared savings contracts as they determine which providers are responsible for the care and outcomes of a specific patient population. Clear and well-defined attribution methodologies are essential to ensure fairness in distributing shared savings among accountable providers. Accurate attribution allows for a more comprehensive evaluation of the impact of provider interventions and facilitates accountability for patient care.

b) Benchmarking: Establishing performance benchmarks is a critical aspect of shared savings contracts. These benchmarks serve as reference points against which providers’ performance is measured. By comparing current performance to predetermined benchmarks, providers can assess the progress made in achieving cost savings and quality improvements. Benchmarks can be based on various factors, such as historical spending patterns, regional or national averages, inflation, evidence-based guidelines, or other relevant metrics that reflect the goals and objectives of the shared savings contract.

c) Care Coordination Fees: Shared savings contracts often include care coordination fees as an additional component. These fees are designed to incentivize effective care coordination efforts among providers. Care coordination plays a vital role in achieving cost savings and improving patient outcomes by ensuring seamless transitions of care, reducing duplicative services, and enhancing care continuity. By providing these financial incentives for care coordination, providers can invest time and resources in implementing care coordination strategies, which ultimately contribute to better patient outcomes and reduced healthcare costs. Care coordination fees are often allocated as upfront shared savings to support the necessary infrastructure costs associated with implementing care coordination initiatives. Typically, these fees fall within a range of $2.50 to $7.00 per member per month, providing financial support for the coordination efforts required to achieve cost savings and enhance patient outcomes.

Effective implementation of these components requires collaboration among various stakeholders, including payers, providers, and care teams. Clear communication and understanding of the attribution rules, transparent benchmarking methodologies, and appropriate compensation for care coordination efforts are essential for successful shared savings contract implementation. By incorporating these key components into shared savings contracts, healthcare providers and payers can align their efforts to drive positive change in healthcare delivery, leading to improved outcomes, increased efficiency, and reduced costs.

Preparing to Participate in a Shared Savings Contract and Mitigate Risk

Before entering into a shared savings contract, thorough preparation is essential to maximize the chances of success. Consider the following factors:

a) Know the Rules: Take the time to thoroughly understand the specific rules and requirements of the shared savings arrangement you are considering. Familiarize yourself with the contractual obligations, reporting mechanisms, performance metrics, and any quality benchmarks that need to be met. Familiarize yourself with the benchmarks that will be used to measure your performance and determine the amount of shared savings achieved. This understanding will enable you to comply with the contractual requirements and optimize your performance.

Knowing the rules and regulations governing the shared savings contracts is crucial for mitigating risk. By understanding the contractual obligations, reporting requirements, and performance metrics, healthcare providers can ensure compliance and avoid penalties. Additionally, being well-versed in the rules allows organizations to leverage best practices such as care coordination, data analytics, and patient engagement strategies to optimize outcomes, improve quality, and achieve shared savings.

b) Know Your Population: Knowing which patients are attributed to you is a fundamental aspect of participating in a shared savings contract. Understanding the attribution methodology utilized by the contract is essential for several reasons. First, it enables you to accurately assess the patient population for whom you will be responsible, allowing you to focus on delivering the most appropriate and effective care. Attribution may be based on various factors such as primary care physician assignment, patient choice, or utilization patterns. By understanding the attribution rules, you can identify the individuals for whom you will be accountable and ensure that you have the necessary resources and capabilities to meet their healthcare needs.

In addition, gain a deep understanding of the characteristics, needs, and healthcare utilization patterns of your patient population. Analyze data on demographics, prevalent conditions, and utilization patterns to identify areas of high cost and opportunities for improvement. This knowledge will help you develop targeted interventions and strategies that are tailored to the specific needs of your population.

c) Knowing Your Spend: Conduct a comprehensive analysis of your organization’s spending patterns. Identify areas of high expenditure, such as readmissions, unnecessary procedures, or inefficient care transitions. By understanding your spending patterns, you can pinpoint opportunities for smarter spending and implement interventions that address these specific areas.

Participating in a shared savings contract is a strategic approach to delivering cost-effective and high-quality care. By understanding the concept, evaluating different arrangements, comprehending the key components, and adequately preparing, healthcare providers can navigate the complexities of shared savings contracts successfully. With the potential to benefit both patients and healthcare organizations, shared savings contracts foster a culture of collaboration and accountability, driving improvements in healthcare delivery.

Distribution of Shared Savings

The distribution of shared savings among participating providers is a critical aspect of shared savings contracts. The methodology for distribution can vary depending on the specific contract and the participating providers.

One common approach to distributing shared savings is based on panel size/attribution and predetermined Key Performance Indicators (KPIs) that effectively capture smarter spending and quality improvement. These KPIs are typically agreed upon at the beginning of the contract and serve as the basis for evaluating providers’ performance. Examples of KPIs may include increased Annual Wellness Visits (AWVs), coordinate transitions of care (inpatient and outpatient facilities), reduced hospital readmissions, improved management of chronic conditions, increased preventive care utilization, or patient satisfaction ratings.

The distribution methodology may involve assigning weights to each KPI, reflecting their relative importance in achieving the overall goals of the contract. Providers who meet or exceed the performance targets for these KPIs are typically eligible to share in the savings generated. The distribution can be based on a percentage of the achieved savings or on a predetermined formula that takes into account each provider’s contribution to the overall cost reduction through coordinated care, smarter spending, and quality improvement. Shared savings can be distributed through various methods. This may include direct financial incentives or bonuses based on individual or group performance. Alternatively, the organization may choose to reinvest a portion of the shared savings into resources and infrastructure that support ongoing quality improvement efforts.

Determining Fair Market Value of Physician Services under Value-Based Initiatives

Compensation paid to physicians for any service, whether clinical or administrative, is included within the financial statements for that physician practice and ultimately on an IRS Form W-2 or K-1 (net of expenses). While some compensation reporting agencies try to break out certain forms of compensation from total cash compensation, in general, all forms of compensation are included in benchmark data.

The fair market value of physician services under value-based initiatives becomes a little bit of a carrot versus a stick type of question. Quality, efficiency, and shared savings payments are generally paid based on the achievement of certain metrics and possibly remuneration from payors for achieving certain goals. The benchmarks report that this compensation has slowly increased from 5% to almost 8% on average of total compensation. This compensation is only what was earned as opposed to the maximum available funds achievable by maximizing success under a value-based program. Quality compensation can also vary significantly based on the acuity weighting of the practice’s patient population, the adoption of value-based payor contracts by the provider entity and payors, and the achievement of goals.

The Stark Law specifically refers to the term “aggregate compensation” and the determination of whether aggregate compensation is consistent with fair market value for the services provided. One of the biggest concerns in assessing if compensation is consistent with fair market value is verifying that the provider is not paid for certain services, such as case coordination or performance of an annual wellness visit, and also receiving compensation for shared savings generated by these efforts.

| Base Compensation | Productivity Bonus | Incentive Compensation | Quality Bonus | Shared Savings | Total Compensation | |

| Physician A | $250,000 | $50,000 | $10,000 | $25,000 | $100,000 | $435,000 |

Under this compensation plan, a primary care physician would earn over the 90th percentile compensation. At around 6,000 wRVUs, the physician would be compensation at around the 75th percentile compensation per wRVU. Incentive compensation is paid for wellness visits, care coordination, and advanced practice provider supervision. Shared savings are generally paid as a percent of actual shared savings achieved ranging from 50% to 80%.

Overall, fair market value for services provided under value-based initiatives should be checked for duplication of payment, comparison to benchmarks, and aggregate compensation.

Conclusion

Over the past decade, significant progress has been made in transitioning the healthcare system from fee-for-service payment to value-based payment. The Centers for Medicare and Medicaid Services (CMS) and other payers have successfully shifted away from outdated payment models. Many providers are now involved in quality-linked payment arrangements, and some have even started exploring advanced forms of population-based payment and practice transformation.

In the next decade, it is crucial to apply the lessons learned by engaging providers who have been slower to adopt value-based payment, scaling up successful APMs that are already in use, driving payment and practice transformation in commercial insurance, and prioritizing equity in value-based payment strategies. Achieving a sustainable healthcare system that pays for better quality, equity, and efficiency is an ambitious yet entirely attainable goal that starts with understanding shared savings contracts/arrangements, and making them more impactful and efficient.

For more information, please contact Curtis Bernstein, Kelly Conroy, or Daniela Yusufbekova.

[1] Measuring Progress: Adoption of Alternative Payment Models in Commercial, Medicaid, Medicare Advantage, and Traditional Medicare Programs. Health Care Payment Learning & Action Network. Retrieved from http://hcp-lan.org/workproducts/apm-methodology-2022.pdf