CMS Fee Schedule Changes for 2026

Centers for Medicare and Medicaid Services (CMS) has finalized the physician fee schedule (PFS) and dealt a significant reimbursement blow to inpatient physician reimbursement.

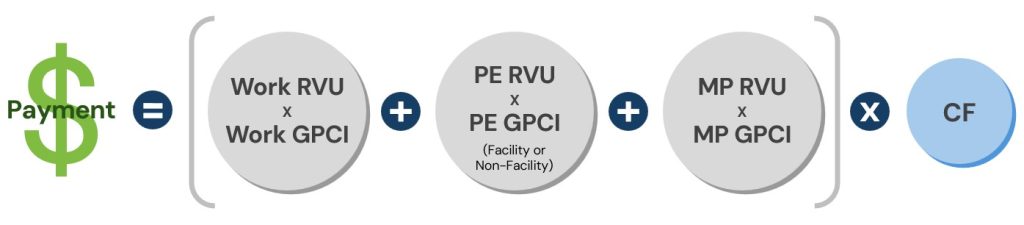

Medicare reimbursement is a complex formula factoring elements of provider work (wRVUs), Practice Expenses (PE RVU), and Malpractice Expenses (MP RVU), then multiplying it by a conversion factor. While the recent positive adjustment to the conversion factor is welcome, adjustments to other elements of the formula result in a compounding negative impact in specialty areas such as hospitalists, intensivists, neuro hospitalists, and other professionals who provide a high percentage of their patient care services in inpatient evaluation and management areas.

In particular, a downward adjustment to the Practice Expense portion of the formula has significantly impacted services delivered in facility settings. CMS has referenced the decline of private practice and corresponding increase in employment by hospitals and health systems as a primary driver of the reasoning behind this adjustment.

This reasoning does not account for the fact that a majority of the costs incurred to provide inpatient medicine remain whether a physician is employed through a hospital or a private practice. Major operating expenses necessary to employ physicians to provide inpatient services include, but are not limited to:

- Provider Compensation – Physician compensation already represents 150% of the medical revenue a hospital medicine provider can generate through services.[1]

- Benefits – Health, dental, life, vision, disability, retirement, and other benefits are significant expenses for both private practices and hospitals and have experience persistent and significant increases over time.

- Revenue Cycle Management – All practices, regardless of ownership, incur significant operating expense just to collect the reimbursement for services rendered. This expense can be 4-8% of all revenues for services rendered just on its own.

- Malpractice Expense – Increasing malpractice expenses are felt in all employment environments and can be particularly severe in states without limitations on awards.

Other essential operating expenses such as office/clinic leases, technology, staff, provider license and credentialing fees, professional development and training, practice management, and recruitment (even in hospital employment environments) all continue to increase at a time reimbursement is decreasing.

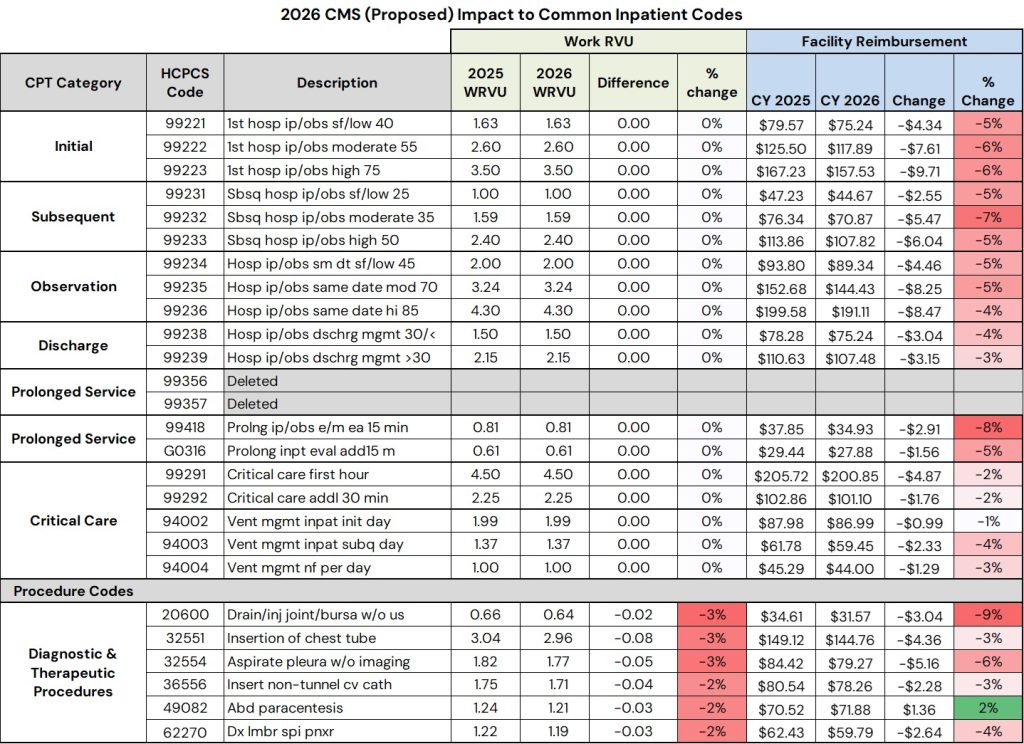

Pinnacle Healthcare Consulting has analyzed the impact to the types of services that are provided by clinicians in an inpatient setting. Every provider and practice will have a unique mix of codes; however, the impact is significant and is across the board!

- Medicine services (initial and subsequent hospital visits) will see a 5-7% decrease

- Critical Care services will see a 2% decrease

- Common procedures like a spinal tap, chest tube, or a central line will see a 3-4% decrease

Impact for Hospitals

- Worsening financial performance of inpatient medicine groups. Reimbursement from Medicare is being reduced; commercial reductions will soon follow. Hospital groups with wRVU models will see larger financial losses as a percent of medical revenue. wRVU values for most of the subject codes did not change which leaves provider compensation unchanged for those relying on those models, even while reimbursement is declining.

As a result of impact # 1, there will be:

- Higher subsidies for groups providing coverage. In order to have physician groups (from small independent groups to large multi-state practices) remain financially viable and able to provide coverage, hospitals will experience requests for increased subsidy support.

- Those hospitals that have contract arrangements with an offset from actual collections will experience higher subsidies as soon as January 2026.

- Hospitals and Health Systems employing inpatient medicine providers may need to reassess their provider compensation models.

Impact for Medical Groups

- Declining reimbursement for services. Reimbursement from Medicare will decline immediately beginning with services on January 1, 2026. Commercial carriers typically follow Medicare reimbursement policy and will begin to do so through the natural cycles of fee schedule adjustment and contract renewal.

- Increased support needs. Coverage support arrangements with hospitals will need to be adjusted upwards to be able to remain competitive with provider compensation and be able to recruit and retain medical professionals.

- Provider compensation models within groups will need to be adjusted if they utilize a wRVU conversion factor of some kind. Models could be at risk of calculating more pay than is actually possible based cash payments.

The fee Medicare PFS changes from 2025 to 2026 are significant. In some areas there are significant positive changes, however inpatient medicine is not one of those areas. What was communicated broadly as an increase is in fact a significant decrease.

The nature of the adjustments CMS has made to the reimbursement formula will have significant negative impacts to the finances of employers of inpatient providers, mostly hospitals and medical groups. Businesses will need to rapidly respond with adjustments to provider compensation models, commercial insurance contracting strategies, staffing models, and other operations.

To learn more about these changes or find out more about the impacts of reimbursement policy changes, please contact Pinnacle Healthcare Consulting.

Lucas Hutchison, Director • (303) 801-0128 • LHutchison@AskPHC.com

Jason Baldwin, Manager • (303) 520-2654 • JBaldwin@AskPHC.com

[1] According to the 2024 MGMA Cost and Revenue Survey (expense as a percent of total medical revenue statistic).