Meet the Authors

Pinnacle Blog

PHC August 2023 Real Estate Practice Newsletter

Posted On:Healthcare Real Estate Transactions

Mountain Point Medical Center – Salt Lake City, UT. JLL Capital Markets, Medical Properties Group announced the sale of Mountain Point Medical Center, a 60,000 square foot medical office building connected to the 40-bed Holy Cross – Mountain Point hospital in Lehi, Utah. The property is 100 percent leased to Centura Health, a non-profit faith-based health care system based in Colorado with 25 hospitals located throughout Colorado, Utah, and Kansas.

Charleston Cancer Center – Charleston, SC. JLL Capital Markets announced it arranged the $10.1 million sale of the Charleston Cancer Center, totaling 26,256 square feet in Charleston, South Carolina at a 5.28% cap rate. The two-story, newly renovated medical office building is located at 2910 Tricom St. The property includes specialty treatment equipment including an infusion area, computed tomography (“CT”) imaging, lab, and an area on the second floor for clinical studies personnel. The Charleston Cancer Center is a single tenant clinical building with multiple cancer related specialties treated within the premises. The center was originally built in 2002 and has received renovations by both current ownership and tenant, RSFH, following Roper’s acquisition of Charleston Oncology.

Mission Critical Healthcare Facility – Providence, RI. JLL Capital Markets announced it advised Sendero Capital and Angelo Gordon on the acquisition of 2 Wake Robin Road, a 30,000-square-foot medical office building in Providence, Rhode Island. The joint venture is focused on value-add and core plus outpatient medical office and surgery center assets throughout the Northeastern United States – a region with high barriers to entry, strong growth, and one of the largest concentrations of healthcare businesses in the U.S. Constructed in 2006, 2 Wake Robin Road is a premier medical office building that is currently 96% leased to Lifespan Health System and clinical medical tenants offering a variety of services, including urgent care, primary care, imaging, pediatric care, physical therapy, and pathology. The building is located less than an hour from Boston and two national airports and is strategically positioned between Landmark Medical Center (6.6 miles) and Miriam Hospital (10 miles).

Healthcare Real Estate Recent Trends

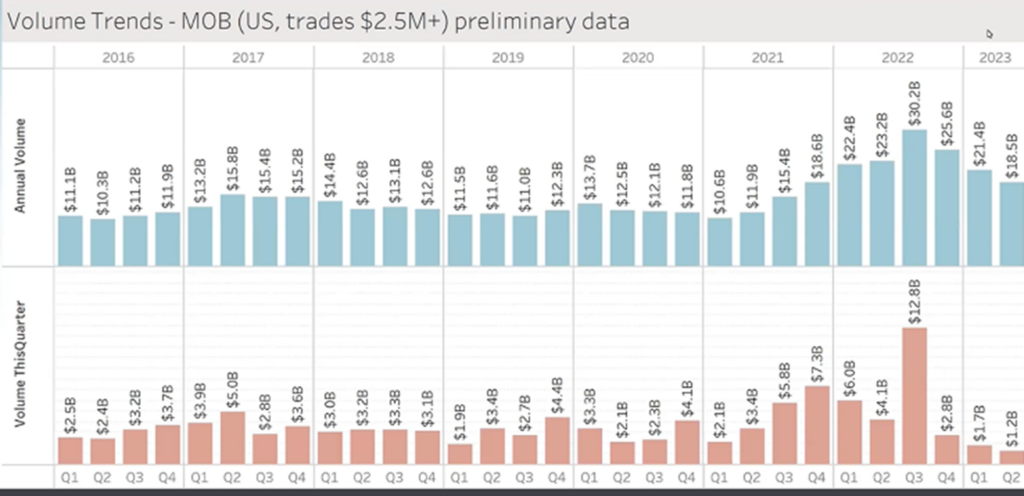

MOB Sales drop and CAP Rates Increase since start of 2023. According to the most recent statistics from Arnold, Md.-based Revista and its healthcare real estate (HRE) data service, RevistaMed, the MOB sales volume in the first half of 2023 fell 71 percent compared to the first half of 2022. Revista’s Q2 Subscriber Webcast information provided MOB sales data showing that the preliminary volume in the second quarter (Q2) was just $1.2 billion, the lowest quarterly volume Revista has recorded since its founding in 2015. When combined with the MOB sales volume of $1.7 billion in Q1, the first half of 2023 saw sales of only $2.9 billion, down, as noted, 71 percent from the $10.1 billion recorded in the first half of 2022. It is worth noting that the records were established in multiple quarters of 2022. Regarding Cap Rates for MOB, the information provided on Revista’s Webcast confirmed that Cap Rates are up approximately 60 basis points from this point last year on a trailing 12-month (TTM) average currently in the 6.5% Cap Rate range.

What will the next twelve months look like regarding the Healthcare Real Estate Industry? The MOB Sales mentioned above is a fairly good indicator of trends for the healthcare real estate industry as a whole. The outlying “high water mark” of $12.8B in Q3 of 2022 seems like an anomaly. Understanding the previous record prior to $12.8B was $7.3B in Q4 of 2021 which at the time was unprecedented confirms that $12.8B was unusual and excessive. Now that this amount is in the rearview mirror, where is the industry heading now? From our perspective we believe we are in a period of correction to the overreaction with the past two (2) quarters being the lowest individually and collectively since these numbers were charted in 2015. Understanding that the current global issues and financial lending market situation will continue through the end of 2023, we expect these low and below average numbers will continue as well into the first (Q1) and possibly second quarter (Q2) of 2024. Regarding rental rates, we believe they have and will continue to stabilize in Q3 and will continue going forward. In addition, we believe the net effective rates that factor concessions such as abated rent will start to lower from previous quarters. Net effective rates are more difficult to confirm but we believe the trend of Landlords providing more concessions to tenants for new and renewal leases will continue through the end of 2023.

For more information, please contact Director Mike Vandaveer at MVandaveer@AskPHC.com, Director Chris Louis at CLouis@AskPHC.com, or Analyst Tony Price at TPrice@AskPHC.com.

Continue reading →PHC 3rd Quarter 2022 Real Estate Newsletter

Posted On:The Pinnacle Real Estate Group consists of a combination of professionals who use their extensive experience in both valuation and transaction services within the healthcare real estate industry to guide clients through multiple types of arrangements in a time-efficient and cost-effective manner.

This Newsletter covers recent activity and conditions specifically impacting the national healthcare real estate market and those who are learning how to succeed in it. The Pinnacle Real Estate Group has compiled the following current market information from sources such as CoStar, CBRE, and HREI.

Healthcare Real Estate Transactions

$10.75 Million MOB acquired in Cleveland Suburb

Joint venture (JV) partners Remedy Medical Properties and Kayne Anderson Real Estate announced they have acquired the 34,519-square-foot Atrium of Brunswick in the Cleveland suburb of Brunswick, OH. The $10.75 million transaction closed August 23. The two-story medical office building (MOB), located at 1299 Industrial Parkway N., is 100 percent occupied by two tenants, including One GI, a gastroenterology group that recently acquired the building’s original tenant and seller Digestive Disease Consultants (DDC). The MOB also houses MetroHealth, which operates four hospitals and other healthcare facilities throughout the Cleveland area. MetroHealth operates a primary care and pediatrics practice at the MOB with rotating specialties including dermatology, rheumatology and sleep medicine.

$15.9 Million Sale of a 51,357 SF Medical Property in Geneseo, NY

SRS Real Estate Partners’ National Net Lease Group (NNLG) announced completion of the $15.9 million sale of a 51,357-square-foot (sf) medical property fully occupied by Rochester Regional Health – Geneseo Medical Campus. Built in 2021 and situated on 6.24 acres at 4302 Gateway Drive in Geneseo, NY, the property has more than 19 years remaining on the corporate-guaranteed lease. Rochester Regional Health is an integrated health system which includes nine hospitals, hundreds of outpatient specialty, urgent care, and primary practices. Its highly upgraded, state-of-the-art Geneseo property features a variety of highly specialized services including cardiology, radiology, endocrinology, orthopedics, dermatology, and general surgery. The property is part of the first phase in a multi-phase development plan on 26 acres that will include retail, office, and hospitality uses.

$37 Million Sale of Skilled Nursing Homes in Florida

Nursing home investor Omega Healthcare sold two Florida facilities in Miami and Jacksonville for a combined $37.2 million in the company’s latest asset disposition. Omega sold the skilled nursing facilities to 1990 South Canal Dr LLC, based in Woodmere, Long Island, New York, according to public documents. Each property was sold for $18.6 million, and Omega collected a profit on both sales.

Healthcare Real Estate New Construction

Los Angeles Approves 12-Story, Class-A Medical Building

Stockdale Capital Partners (“Stockdale”), a Los Angeles-based, vertically-integrated real estate investment firm, won approval from the Los Angeles City Council for its 145,000 square-foot, Class-A medical building on Los Angeles’ Westside, adjacent to the City of Beverly Hills at the intersection of San Vicente and Wilshire Boulevards. Located near major health care facilities including Cedars-Sinai Medical Center, UCLA Medical Center, and numerous other medical specialists’ offices in the area, 656 S. San Vicente Blvd. is the first major outpatient medical office building built in the area in over twenty years, meeting pent-up demand by healthcare systems and physicians in the area with an extremely low vacancy rate of 5% or less since the Beverly Hills medical office moratorium was enacted in 2011. 656 S. San Vicente Blvd. is designed to accommodate modern, higher-acuity procedures such as surgery and other invasive outpatient services that are not easily-placed in the older building stock of the West Los Angeles office markets. In addition to modern, patient centered medical space, 656 will also be home to state-of-the-art laboratory space that will serve the needs of medical researchers and focused studies in a supply-constrained market for both medical office and life science.

Pinnacle Real Estate Group Assessment

MOB Sales Drop for Second Consecutive Quarter Confirming a Bubble in Activity

As indicated in our previous newsletter, the estimated MOB Sales numbers for Q2 2022 were $3.6B, which was considered strong and above recent historical average but significantly lower than the previous six quarters. That downward trend has continued with the estimated MOB Sales numbers for Q2 2023 estimated at $2.6B, which is the lowest quarterly total since $2.1B posted in Q1 2021. This trend is predictable and probably necessary understanding the consistent rate hikes The Fed has made over this 2022 calendar year, with the latest being the first week of November, combined with many other active factors. Because of this trend the CAP Rates for MOB Sales have started to increase from 5.25% at the beginning of 2022 to now in the 6.15% range at the end of the Q3. Over the past two years, these MOB Sales numbers have confirmed a bubble in activity. However, unlike bubbles in other markets, there need not be panic or fear of a crash. Essentially, for the MOB Sales market it took advantage of multiple opportunistic factors and is now stabilizing back to a sustainable range. We believe this sustainable range will continue for the foreseeable future.

For more information, please contact:

Mike Vandaveer, Director

720-599-7883

MVandaveer@AskPHC.com

Chris Louis, ASA, MAI, Director

720-598-1439

CLouis@AskPHC.com

Tony Price, Analyst

720-386-3540

TPrice@AskPHC.com

Continue reading →PHC 3rd Quarter 2022 Real Estate Newsletter

Posted On:The Pinnacle Real Estate Group consists of a combination of professionals who use their extensive experience in both valuation and transaction services within the healthcare real estate industry to guide clients through multiple types of arrangements in a time-efficient and cost-effective manner.

This Newsletter covers recent activity and conditions specifically impacting the national healthcare real estate market and those who are learning how to succeed in it. The Pinnacle Real Estate Group has compiled the following current market information from sources such as CoStar, CBRE, and HREI.

Healthcare Real Estate Transactions

$10.75 Million MOB acquired in Cleveland Suburb

Joint venture (JV) partners Remedy Medical Properties and Kayne Anderson Real Estate announced they have acquired the 34,519-square-foot Atrium of Brunswick in the Cleveland suburb of Brunswick, OH. The $10.75 million transaction closed August 23. The two-story medical office building (MOB), located at 1299 Industrial Parkway N., is 100 percent occupied by two tenants, including One GI, a gastroenterology group that recently acquired the building’s original tenant and seller Digestive Disease Consultants (DDC). The MOB also houses MetroHealth, which operates four hospitals and other healthcare facilities throughout the Cleveland area. MetroHealth operates a primary care and pediatrics practice at the MOB with rotating specialties including dermatology, rheumatology and sleep medicine.

$15.9 Million Sale of a 51,357 SF Medical Property in Geneseo, NY

SRS Real Estate Partners’ National Net Lease Group (NNLG) announced completion of the $15.9 million sale of a 51,357-square-foot (sf) medical property fully occupied by Rochester Regional Health – Geneseo Medical Campus. Built in 2021 and situated on 6.24 acres at 4302 Gateway Drive in Geneseo, NY, the property has more than 19 years remaining on the corporate-guaranteed lease. Rochester Regional Health is an integrated health system which includes nine hospitals, hundreds of outpatient specialty, urgent care, and primary practices. Its highly upgraded, state-of-the-art Geneseo property features a variety of highly specialized services including cardiology, radiology, endocrinology, orthopedics, dermatology, and general surgery. The property is part of the first phase in a multi-phase development plan on 26 acres that will include retail, office, and hospitality uses.

$37 Million Sale of Skilled Nursing Homes in Florida

Nursing home investor Omega Healthcare sold two Florida facilities in Miami and Jacksonville for a combined $37.2 million in the company’s latest asset disposition. Omega sold the skilled nursing facilities to 1990 South Canal Dr LLC, based in Woodmere, Long Island, New York, according to public documents. Each property was sold for $18.6 million, and Omega collected a profit on both sales.

Healthcare Real Estate New Construction

Los Angeles Approves 12-Story, Class-A Medical Building

Stockdale Capital Partners (“Stockdale”), a Los Angeles-based, vertically-integrated real estate investment firm, won approval from the Los Angeles City Council for its 145,000 square-foot, Class-A medical building on Los Angeles’ Westside, adjacent to the City of Beverly Hills at the intersection of San Vicente and Wilshire Boulevards. Located near major health care facilities including Cedars-Sinai Medical Center, UCLA Medical Center, and numerous other medical specialists’ offices in the area, 656 S. San Vicente Blvd. is the first major outpatient medical office building built in the area in over twenty years, meeting pent-up demand by healthcare systems and physicians in the area with an extremely low vacancy rate of 5% or less since the Beverly Hills medical office moratorium was enacted in 2011. 656 S. San Vicente Blvd. is designed to accommodate modern, higher-acuity procedures such as surgery and other invasive outpatient services that are not easily-placed in the older building stock of the West Los Angeles office markets. In addition to modern, patient centered medical space, 656 will also be home to state-of-the-art laboratory space that will serve the needs of medical researchers and focused studies in a supply-constrained market for both medical office and life science.

Pinnacle Real Estate Group Assessment

MOB Sales Drop for Second Consecutive Quarter Confirming a Bubble in Activity

As indicated in our previous newsletter, the estimated MOB Sales numbers for Q2 2022 were $3.6B, which was considered strong and above recent historical average but significantly lower than the previous six quarters. That downward trend has continued with the estimated MOB Sales numbers for Q2 2023 estimated at $2.6B, which is the lowest quarterly total since $2.1B posted in Q1 2021. This trend is predictable and probably necessary understanding the consistent rate hikes The Fed has made over this 2022 calendar year, with the latest being the first week of November, combined with many other active factors. Because of this trend the CAP Rates for MOB Sales have started to increase from 5.25% at the beginning of 2022 to now in the 6.15% range at the end of the Q3. Over the past two years, these MOB Sales numbers have confirmed a bubble in activity. However, unlike bubbles in other markets, there need not be panic or fear of a crash. Essentially, for the MOB Sales market it took advantage of multiple opportunistic factors and is now stabilizing back to a sustainable range. We believe this sustainable range will continue for the foreseeable future.

For more information, please contact:

Mike Vandaveer, Director

720-599-7883

MVandaveer@AskPHC.com

Chris Louis, ASA, MAI, Director

720-598-1439

CLouis@AskPHC.com

Tony Price, Analyst

720-386-3540

TPrice@AskPHC.com

Continue reading →PHC 2nd Quarter 2022 Real Estate Newsletter

Posted On:The Pinnacle Real Estate Group consists of a combination of professionals who use their extensive experience in both valuation and transaction services within the healthcare real estate industry to guide clients through multiple types of arrangements in a time-efficient and cost-effective manner.

This Newsletter covers recent activity and conditions specifically impacting the national healthcare real estate market and those who are learning how to succeed in it. The Pinnacle Real Estate Group has compiled the following current market information from sources such as CoStar, CBRE, and HREI.

Healthcare Real Estate Transactions

Amazon’s Latest Deal Marks $3.9 Billion Bet on Brick-and-Mortar Healthcare

Amazon agreed to buy 1Life Healthcare establishing the online retail giant in the healthcare industry with a plan to disrupt it. One Medical, owned by 1Life, has 188 primary care facilities that provide virtual and in-office services, and competes with another Amazon experiment. This deal gives Amazon a turnkey entry into part of the healthcare market valued at upwards of $300 billion. However, it also opens the tech giant to risk as it acquires a not-yet-profitable firm in a highly competitive industry. This is not Amazon’s first move into healthcare, acquiring online pharmacy PillPack in 2018 and the healthcare startup HealthNavigator in 2019. Last year, Amazon expanded its in-house Amazon Care program to its employees nationwide, immediately drawing comparisons to Amazon’s 2017 purchase of Whole Foods – its $13 billion entry into customer-facing brick-and-mortar operations. Similarly, we saw Amazon purchase an up-and-running brand with hopes that its tech and management expertise could disrupt a new sector. Now, it’s a waiting game to see how Amazon’s perseverance in the healthcare industry compares to that of the grocery sector. One Medical has operations in 25 markets across the country and described its physical locations as “well-appointed” in federal filings. The company claims 767,000 members, a number it conceded in its most recent quarterly report would need to grow to achieve profitability. It recorded a $254.6 million loss in 2021.

Abbott Laboratories Life Science Campus in Minneapolis Trades Hands

JLL Capital Markets, working alongside CBRE, announced it has closed the sale of Abbott Laboratories Life Science Campus, a four building, 280,289-square-foot life science portfolio in Minneapolis, Minnesota. JLL and CBRE co-marketed the property on behalf of the seller, a joint venture between Eagle Ridge Partners and Syndicated Equities. Virtus Real Estate Capital (“Virtus”) acquired the portfolio. Abbott Laboratories Life Science Campus is fully leased to A+ investment grade credit tenant, Abbott Laboratories. The portfolio contains cGMP (“Current Good Manufacturing”) certified clean room, lab, and manufacturing space, as well as office and warehouse space. Across the four buildings located on 19.13 acres in the southwest submarket, there are 26 dock doors, 7 drive-ins, clear heights of 12-18 feet, and 640 parking spaces. Abbott Laboratories Life Science Campus has convenient access to the area’s vast transit system, including the Light Rail Transit system, regional freeways, and the Minneapolis-St. Paul International Airport.

Healthcare Real Estate New Construction

Vanderbilt Plans $500 Million Expansion of Nashville Hospital

Vanderbilt University Medical Center plans to build a $500 million medical tower at the primary hospital in Nashville, TN. The new building will be designed to serve as an inpatient facility with an expected completion date in 2027. The tower will be constructed above a parking deck between 21st Avenue South and Medical Center Drive. The new tower will provide 180 new beds whereas the current facility has been consistently strained, operating at more than 90% capacity. The 470,000 square foot structure will be connected to the main hospital building by multiple pedestrian bridges over existing streets. Another building on the campus will be demolished as a step in the process. VUMC is independent from the 14,000-student university but maintains an academic affiliation with its medical school. Vanderbilt Health System serves patients in middle Tennessee, northern Alabama, and portions of Kentucky. In addition to its Nashville hospital, the system also operates clinics in suburban and rural areas.

Pinnacle Real Estate Group Assessment

Healthcare Real Estate Remains an Attractive Option Despite MOB Sales Drop In 2nd Quarter

The healthcare real estate industry, specifically MOB Sales, broke records the previous four quarters cumulatively, with Q4 2021 being the highest ever recorded at $7.3B. In the past few years, the quarterly average is in the $3B range with Q3 2021 at $5.7B, Q4 at $7.3B, and Q1 2022 at $4.6B. The preliminary numbers for Q2 2022 are $3.6B, which is still considered strong and above recent historical averages. However, it does indicate things seem to be coming back to “normal” with the excess of capital that flooded multiple market sectors – which is understandable and somewhat expected due to current inflation, multiple recent interest rate hikes, and what seems to be the conclusion of the financial reaction to the pandemic from the past two years. Other market statistics for healthcare real estate remain strong: occupancy rates remain stable around 92%, and rental rates continue an upward trend with the national average around $23.72 per square foot with an annual increase close to two percent (2%). However, in addition to a drop in MOB sales, there is an expected drop in new construction starts which are expected to continue trending moving forward while the current volatility in the market remains. It seems the white-hot trends for healthcare real estate the past twelve to eighteen months peaked after Q1 2022 and will stabilize for the foreseeable future while remaining an attractive option for investors.

For more information, please contact:

Mike Vandaveer, Director

720-599-7883

MVandaveer@AskPHC.com

Chris Louis, ASA, MAI, Director

720-598-1439

CLouis@AskPHC.com

Tony Price, Analyst

720-386-3540

TPrice@AskPHC.com

Continue reading →PHC 1st Quarter 2022 Real Estate Newsletter

Posted On:PHC 1st Quarter 2022 Real Estate Newsletter

The Pinnacle Real Estate Group consists of a combination of professionals who use their extensive experience in both valuation and transaction services within the healthcare real estate industry to guide clients through multiple types of arrangements in a time-efficient and cost-effective manner.

This Newsletter covers recent activity and conditions specifically impacting the national healthcare real estate market and those who are learning how to succeed in it. The Pinnacle Real Estate Group has compiled the following current market information from sources such as CoStar, CBRE, and HREI.

Healthcare Real Estate Transactions and New Construction

Life Science Firm, Seagan, Plans for 270,000 Square Foot Facility in Everett, Washington

The new facility which Seagan will commit to a long term lease is scheduled to be completed in 2024 and will office approximately 200 works will be focused on manufacturing the company’s cancer treatment medicines. The Seattle area is on of the nation’s 12 largest biotech clusters where the pipeline of life science projects has reached approximately 25 million square feet.

Montecito Medical Acquires MOB in Hazelton, Pennsylvania

The 73,255 square foot, multi-tenant, two story building is 100% leased to Lehigh Valley Health Network. The building includes a 13,500 square foot ASC. The purchase price was not disclosed but believed to be approximately $29.2M in a transaction where Montecito partnered with AEW Capital Management.

PMB & Dignity Health Break Ground on a 45,000 SF MOB in Gilbert, Arizona

The two story project is the third MOB located near the Dignity Health Mercy Gilbert Medical Center developed by PMB. The new facility is scheduled to be completed in 2023 will include Dignity Health East Valley’s graduate medical program and supporting imagining services via Arizon Diagnostic Radiology. The building is designed in a cost-effectie manner to ensure rents are close to market.

A $650M Business Investment Project For Development of a 500,000 Square Foot Biomanufacturing Facility in Manhattan, Kansas

Governor Laura Kelly announced her administration’s most significant economic development project to date. Scorpion Biological Services, a subsidiary of Heat Biologics, Inc., is commencing on a planned development of a new 500,000 square foot biomanufacturing facility in Kansas. The $650 million business investment project will create 500 new, high-paying jobs in Manhattan within the next seven years and support the development of vaccines.

Healthcare Real Estate Trends

MOB Sales: Estimated more than $3.8B in Q1 2022 concludes highest 12-month total

The first quarter of 2021 for MOB Sales was not impressive with a $2.1B total. However, the final total for 2021 was $18.3B which is 15.3% higher than the next highest total confirmed by Revista ($15.5B in 2017). The first quarter of 2022 has continued that path with preliminary numbers indicating a volume of $3.8B, which is up 90% form first quarter 2021 and the second highest first quarter MOB sales recorded by Revista since the record of first quarter 2017 ($3.9B). This strong start to 2022 has totaled more than $20B in the past 12 months, which is the largest volume recorded by Revista for such a timeframe.

Pinnacle Real Estate Group Assessment

The Second Quarter 2022 Likely to Continue on its Impressive Path

The healthcare real estate industry for First Quarter 2022 continued on the unprecedented momentum generated in the past three quarters. With the current reality of inflation, the ongoing issues with global supply chain issues, the war in Ukraine, combined with the First Quarter 2022 of the overall economy showing signs of a looming recession the healthcare real estate industry continues to show resiliency and maintain on its impressive path. In the past few months, the sector of healthcare real estate that has firmly grabbed the baton and is clearly leading the industry are Life Sciences, or sometimes referred to as BioTech. Life Sciences Real Estate (LSRE) is generating its own momentum and demanding attention throughout the entire healthcare real estate industry. Life Sciences involves the study of living organisms: biology, botany, zoology, microbiology, and other related subjects such as biotechnology, pharmaceuticals, medical devices and therapeutics. LSRE facilities will typically involve a combination of office, lab, and Research and Development (R&D). Venture capital funding in U.S. life sciences has grown 328 percent during the last five years which included $32.5 billion in 2021. There is currently 172.5 million square feet of LSRE in the U.S. with a current vacancy rate of 4.8% that raised average annual rental rate to $67.05 per square foot and cultivated 31.6 million square feet of new construction projects. Investments in LSRE reach $21.4 billion in 2021, which is 62% increase from 2020. We believe LSRE will aggressively continue on this path for the foreseeable future and continue to lead healthcare real estate on its impressive trend.

For more information, please contact:

Mike Vandaveer, Director

720-599-7883

MVandaveer@AskPHC.com

Chris Louis, ASA, MAI, Director

720-598-1439

CLouis@AskPHC.com

Tony Price, Analyst

720-386-3540

TPrice@AskPHC.com

Continue reading →PHC January 2022 Real Estate Newsletter

Posted On:PHC January 2022 Real Estate Newsletter

The Pinnacle Real Estate Group consists of a combination of professionals who use their extensive experience in both valuation and transaction services within the healthcare real estate industry to guide clients through multiple types of arrangements in a time-efficient and cost-effective manner.

This Newsletter covers recent activity and conditions specifically impacting the national healthcare real estate market and those who are learning how to succeed in it. The Pinnacle Real Estate Group has compiled the following current market information from sources such as CoStar, CBRE, and HREI.

Healthcare Real Estate Transactions and New Construction

National Real Estate Advisors and Catalyst Healthcare Real Estate Invest $420 Million Across Two Portfolios

National Real Estate Advisors, LLC (“National”), an investment manager developing and managing large-scale projects on behalf of its clients, through its recently formed joint venture with Catalyst Healthcare Real Estate (“Catalyst”), has completed the acquisition and recapitalization of two multi-state healthcare portfolios totaling $420 million. The portfolios consist of 40 properties totaling 1.2 million square feet, spanning 13 states including: Alabama, Arkansas, Connecticut, Florida, Georgia, Illinois, Indiana, Louisiana, Massachusetts, North Carolina, Tennessee, Texas, and Virginia. The portfolios are 92% leased and 88% of the total leased space is comprised of health systems and regional physician groups.

Newmark Completes $815 Million Sale of Charles Park in Cambridge, Massachusetts

Newmark announces the $815 million sale of Charles Park, a two-building office complex and associated parking garage located in Cambridge, Massachusetts. The 408,259-square-foot Charles Park comprises two Class A office buildings—One Rogers Street and One Charles Park—complemented by a 656-space, seven-level parking garage. It features reusable in-place infrastructure for life science development, including large floor plates that can provide up to 65,000 square feet of contiguous space on one level, 13′ to 17′ ceiling heights and substantial loading capacity with five loading docks and two freight elevators.

Regency Sells San Diego Retail Property Ahead of Planned Conversion to Biotech Space

Regency Centers Corp. has sold a large San Diego retail property to biotech-focused Alexandria Real Estate Equities for $125 million, ahead of the buyer’s planned conversion of the site into a mixed-use development emphasizing the high demand for life sciences offices and laboratories. The 33-year-old Costa Verde Center, spanning about 178,000 square feet at 8508-8650 Genesee Ave. in the city’s University Town Center neighborhood was sold “for the proposed development of office/laboratory space.”

Healthcare Real Estate Trends

Biotech Construction not Keeping Pace with Rapidly Rising Nationwide Demand

Escalating demand for new life science laboratory space is outpacing speculative construction in one of the nation’s fastest-growing types of commercial real estate. A new report from brokerage CBRE points to several cities where the amount of speculative lab space under construction trails demand from companies scouting those regions for life science space. While about 21 million square feet of biotech space is under construction in the nation’s 12 largest life sciences markets, tenants are in the market for 23.8 million square feet. Much of this activity was underway before the pandemic, and the push for coronavirus vaccines and treatments has ramped up the flow of venture and government funding, spurring biotech firm expansion. Developers in the biggest biotech hubs are finding much of their speculative space preleased long before expected project completion dates.

Pinnacle Real Estate Group Assessment

The healthcare real estate industry for Calendar Year 2021 exceeded most expectations, broke records, and generated an unprecedented amount of momentum. For varying reasons, primarily caused by reactions to the pandemic, the healthcare industry positioned itself as a stable, well performing, and attractive investment asset that in some aspects in a relatively quick amount of time leapfrogged over traditional retail and office properties from the perspective of large institutional investors. We believe this trend will continue for Calendar Year 2022 for numerous reasons including the surge created within the past nine plus months will simply perpetuate through a majority of this year without much resistance. However, the question that some are considering is when will the known obstacles begin to slow down the momentum built. The primary looming obstacle is inflation, which to some seems like it should have already occurred at this point, and it is more a matter of when than if. Another obstacle that has surfaced the past year and will likely cause issues on a variety of levels and within numerous industries going forward, including healthcare real estate, are global supply chain issues which will directly impact timing and costs associated with new development construction projects as well as inventory of goods and supplies. Overall, we expect healthcare real estate to continue its success but like other industries there will be obstacles to consider for Calendar Year 2022.

For more information, please contact:

Mike Vandaveer, Director

720-599-7883

MVandaveer@AskPHC.com

Chris Louis, ASA, MAI, Director

720-598-1439

CLouis@AskPHC.com

Tony Price, Analyst

720-386-3540

TPrice@AskPHC.com

Continue reading →October 2021 Real Estate Newsletter

Posted On:Healthcare Real Estate Transactions and New Construction

Easterly, Through JV, Agrees to Acquire 1.2 Million SF VA Portfolio for $635.6 Million.

Easterly Government Properties Inc. (NYSE: DEA) announced last Wednesday, October 13th, that it has formed a joint venture (JV) to acquire a 1,214,165 square foot portfolio of 10 properties 100 percent leased to the U.S. Department of Veterans Affairs (VA), for a purchase price of about $635.6 million. The acquisitions, which Easterly says will close “on a rolling basis” by the end of 2023, include three properties in Texas, two in Georgia and one each in Tennessee, Kansas, Alabama, Arizona and Florida. The 100 percent build-to-suit, Class A properties are either recently delivered or under construction, and the average lease term is 19.6 years.

Southeast Gateway Medical Office Portfolio Sold.

The Portfolio consists of eleven medical office properties located in some of the most desirable markets in the Southeastern US. The Properties are concentrated within the Atlanta, Nashville and Charlotte MSAs and benefit from the exceptional, high-growth demographic trends that define the region. The Portfolio is 95% leased with a roster of tenants that is 69% composed of health systems and credit quality physician groups, representing a diverse mix of clinical specialties. Health system tenants within the Portfolio include Piedmont Healthcare, Northside Hospital, WellStar Health System, Emory Healthcare, Children’s Healthcare of Atlanta, Vanderbilt Health, TriStar Medical Group / HCA, U.S. Department of Veteran Affairs, Atrium Health, and Novant Health.

Hammes Healthcare Celebrates Groundbreaking.

Construction has been progressing since 2020, converting a Sears building in Marketplace Mall into an ambulatory surgery center, and the ceremony marked the start of the project’s 4-story outpatient clinical tower. UR Medicine’s new ambulatory orthopedic campus will span more than 400,000 square feet to provide clinical care, education, research, and community wellness. Upon opening in late 2022, the ambulatory surgery center will have eight operating rooms with additional pre- and post-operative rooms to support the most complex orthopedic surgical procedures. The new tow is set to open in late 2023 will house health and wellness and admin spaces.

Healthcare Real Estate Trends

Portfolio Sales Dominate Third Quarter

Since late September there have been multiple sizable portfolio transactions in the healthcare real estate industry. According to Revista portfolio sales represented more than sixty percent (60%) of the $4.6 billion of total MOB sales volume in the third quarter. In addition to the two (2) porfolio transactions mentioned above there were also the following transactions: A portfolio, known as the I-95 Portfolio with properties in Rhode Island, includes twelve (12) assets totaling 573,554 square feet of space was acquired by a Joint Venture of Evergreen Medical Proerties and Bain Capital. A three (3) MOB portfolio in Federick, Maryland was recently acquired by BentallGreenOak. A portfolio of twenty-nine (29) facilities in ten (10) states owned by The Inland Real Estate Group received $220 million in financing for the portfolio that includes 720,000 SF of healthcare space.

Pinnacle Real Estate Group Assessment

Healthcare Real Estate Continues Its Positive Trajectory in 2021.

Now that the third quarter of 2021 has concluded we can look back and confirm that the Healthcare Real Estate Industry is trending upward with a positive trajectory. In our previous newsletters we have mentioned our opinions on this trend and would like to confirm with statistics. The third quarter was a strong for MOBs with a sales total of $4.6 billion, which is the second highest quarterly total since 2015, with first being $4.9 billion of sales in second quarter of 2017. The year-to-date total for 2021 is $9.6 billion, which assumes that the Healthcare Real Estate Industry will once again reach more than $10 billion of sales for seven (7) consecutive years. The trailing twelve-month (TTM) total after third quarter 2021 was $13.7 billion was the highest since first quarter of 2018 TTM sales were $14.6 billion. Overall, we believe that unless the effects of the pending inflation begins to materialize or an unknown critical market issue arises this positive trend will continue through the end of 2021 with the potential for the TTM totals in 2022 quarters to reach 2017 levels over $15 billion.

Christopher Louis, ASA, MAI

Director

720-598-1439

CLouis@AskPHC.comMike Vandaveer

Director

720-599-7883

MVandaveer@AskPHC.comTony Price

Continue reading →

Analyst

720-386-3540

TPrice@AskPHC.comSeptember 2021 Real Estate Newsletter

Posted On:Healthcare Real Estate Transactions and New Construction

World’s First COVID-Conscious Skyscraper and Medical Center.

An all-in-one residential, hotel, and medical skyscraper in downtown Miami was recently annuonced. Miami Worldcenter is currently the nation’s largest urban core construction project and America’s second-largest real estate development. The 55-story, $500-million, 600-foot-tall Legacy Tower at the Mammoth Miami Worldcenter is the result of a revolutionary joint venture and partnership between Adventist Health, Accor Hotels, Blue Zones, Royal Palm Companies. Who are these companies? Adventist Health is one of the nation’s largest not-for-profit, faith-based hospital and healthcare systems; Blue Zones, the global leader in human longevity research; Accor Hotels, one of the world’s largest hospitality companies; and the Royal Palm Companies — Florida’s preeminent luxury high-rise real estate development firm. The Legacy Tower’s $100-million, 120,000-square-foot, state-of-the-art medical center will be the most technologically advanced health and wellbeing facility in the world, according to Royal Palm Companies CEO, Daniel Kodsi.

KKR Targets $1 Billion in Healthcare Properties.

The New York private equity giant and Cornerstone Companies, a full-service healthcare real estate investment firm, entered a joint venture to acquire and develop a portfolio of diversified medical properties across the country. The pair started off by seeding the portfolio with a recapitalization of 25 healthcare properties owned by Indianapolis-based Cornerstone. Together, they plan to buy more than $1 billion in real estate at a time when demand for healthcare services and medical testing have increased with the spread of COVID-19.

Purchase of 107,228 Square Foot MOB in Maine.

Davis Medical Investors LLC has acquired the 10-story, 107,228-square-foot 84 Marginal Way building on 1.37 acres in Portland’s popular Bayside district. The Class A, 100 percent leased building is anchored by InterMed, Maine’s largest private medical practice. 84 Marginal Way is InterMed’s flagship location and it delivers a wide variety of services including: internal medicine, pediatric medicine, family practice, physical therapy, obstetrics and gynecology, dermatology, emergency medicine, cardiology, audiology, and sports medicine.

Healthcare Real Estate Trends

Recapitalization of Three (3) Healthcare Real Estate Portfolios.

In the past couple of weeks, there have been announcements of three (3) fairly significant Recapitalization transactions in the healthcare real estate industry. A $245M, 31 building portfolio, totaling 545,813 square feet across 10 states was announced by JLL who represented Montecito Medical Real Estate in arranging the terms with AEW Capital Management. CBRE announced the recapitalization of the RG Real Estate (RGRE) portfolio comprised of a 10 MOB properties totaling 222,337 square feet in the Atlanta, Georgia MSA. Newmark represented Global Nephrology Solutions (GNS) involving a portfolio of 15 dalysis and MOB facilities totaling 160,854 square feet in Arizona and Florida.

Pinnacle Real Estate Group Assessment

Healthcare Real Estate Taking Advantage of Recent Popularity through Recapitalization and Monetization.

In last month’s August newsletter, we assessed that healthcare real estate, primarily because of its stability through the pandemic, has become a respected and highly sought-after sector of commercial real estate industry the past twenty plus months from an investment perspective. Popularity has created a trend for retail and office type properties to be transitioned / redeveloped into healthcare facilities. The newfound popularity combined with other factors including the sustaining lower cost of capital, is creating another trend of Recapitalization and Monetization for healthcare entities. As mentioned above, recently there are three (3) separate healthcare entities that have finalized fairly significant transactions related to this trend. The reason being, healthcare entities are taking advantage of the steadily increasing values of their commercial real estate assets and using it for a variety of scenarios, that for the most part, fortify the entities’ current financial situation and capability going forward. This Recapitalization and Monetization opportunity could help the healthcare entity stabilize its overall financial situation if it experienced a downturn during the pandemic or has any existing financial struggles. This trend can allow a healthcare entity to upgrade and expand its facility or overall portfolio. It can also provide opportunities to partner and joint venture with legitimate Capital entities for current and future needs. This trend may not be suitable for every healthcare entity, but we do believe unless something drastically changes the current market conditions, this trend of Recapitalization and Monetization within healthcare real estate will continue going forward and provide opportunities for varying sectors in both the healthcare and commercial real estate industries combined.

Christopher Louis, ASA, MAI

Director

720-598-1439

CLouis@AskPHC.comMike Vandaveer

Director

720-599-7883

MVandaveer@AskPHC.comTony Price

Continue reading →

Analyst

720-386-3540

TPrice@AskPHC.comAugust 2021 Real Estate Newsletter

Posted On:Healthcare Real Estate Transactions and New Construction

Texas Children’s $201 Million Expansion in Houston

Texas Children’s is planning to reconfigure the real estate at its existing 15-story tower at 6620 Main St., which is getting renamed Main Tower, as well as changing its operations across the street at 6651 Main St. Texas Children’s bought 6620 Main St. from Baylor St. Luke’s Medical Center in 2016. Baylor College of Medicine vacated two of three of its floors in 2020 and still leases one floor in the building, a Texas Children’s spokeswoman said. The first phase of the expansion plan is expected to be completed in the spring of 2022. The full expansion is expected to be completed in 2024. The two buildings will be connected by a newly constructed skybridge. In total, the project gives Texas Children’s another 190,000 square feet of usable space within its existing buildings.

Biotech Firm Artiva Leases Large Space for New Headquarters in San Diego

San Diego-based Artiva, which develops cancer-related therapies and treatments, leased 52,000 square feet at a building currently under redevelopment by owner Alexandria Real Estate Equities at 5505 Morehouse Drive. The space will house new research, manufacturing and laboratory facilities after Alexandria completes construction in 2022, as Artiva expands from its current location in the city’s University Town Center neighborhood.

Anchor Purchases MOB in San Diego Area

Anchor has closed on a 54,703 square foot, two story medical office building located in the Oceanside/Vista submarket of San Diego. This select building is one of the top remaining third-party owned assets in the San Diego MSA. The building is located conveniently by the Tri-City Medical Center, a 320-bed hospital district campus serving the North San Diego County. The facility contains an on-site pharmacy, secured subterranean physician parking, open atrium, and ample on-site parking for patients and visitors. Anchor will provide go forward asset and property management at this location.

Healthcare Real Estate Trends

MOB Delays and CAP Rates

MOB project completions continue to slow in 2Q, down to 17 million square feet in annual deliveries. This is the lowest pace of deliveries in the last 6 years and represents a 32% decrease from the annual run rate of 25.1 million SF in deliveries in 1Q2020- just before the onset of COVID and all the related shutdowns, restrictions and labor shortages. Despite all of these headwinds, project starts have remained remarkably stable, suggesting the pandemic has largely been causing project delays after breaking ground. In addition, CAP rates for MOB properties are continuing a trend of compressing during the past several years. Updated 2nd quarter, 2021 Revista data reveals the median MOB cap rate was 5.8%. This was down from 6% in 1Q21 and 6.3% one year ago. This compression is consistent with heightened investor demand.

Pinnacle Real Estate Group Assessment

Healthcare Real Estate Continues to Gain Momentum and Popularity

The world has significantly changed and continues to change in the past twenty plus months on varying levels and wide-ranging aspects. One of those changes is with the previous perception and now reality of healthcare real estate. Prior to the beginning of 2020 the general consensus within the commercial real estate industry was healthcare was a niche subsection of the industry due to its inherent differences to other sectors along with its more complicated and specialized aspects. Because of that it only involved only a relatively small group and was not considered on the same level as industrial, retail, office, and multi-family which resulted in healthcare properties historically receiving higher CAP Rates compared to their cohort sectors. With the combination of recent factors the past twenty months to include but not limited to: the COVID-19 pandemic and reaction to it, the “Amazon Effect” on retail, the “Zoom/Teams Effect” on office buildings, the resiliency of the healthcare industry, along with several other factors, the previous perception and reality of the healthcare real estate has now drastically changed which we believe will continue indefinitely. Not only has the environment since early 2020 leveled the playing field it has turned some factors completely upside down. The “retailization” of Medical space, also known as “Medtail”, where retail properties are being converted to medical has been gaining momentum is now continuing into office properties. With the combining factors of increasing construction costs, delays on new development projects, and increased funds flowing into the healthcare sector, the “officeization” or “Medfice” type projects, both new terms we believe will start to quickly catch, seems destined to become a continued growing aspect of the commercial real estate industry in the foreseeable future. To conclude, we believe healthcare real estate is removing the niche perception and becoming a popular component of the commercial real estate industry.

Christopher Louis, ASA, MAI

Director

720-598-1439

CLouis@AskPHC.comMike Vandaveer

Director

720-599-7883

MVandaveer@AskPHC.comTony Price

Continue reading →

Analyst

720-386-3540

TPrice@AskPHC.comJuly 2021 Real Estate Newsletter

Posted On:Healthcare Real Estate Transactions and New Construction

$1 Billion Hospital Campus to Serve As Centerpiece of Remade Landmark Mall in Alexandria, Virginia

Foulger-Pratt to redevelop the 52 Acre tract into a walkable urban village to include medical office buildings, multifamily units, retail, commercial, and entertainment offerings. At the heart of the redevelopment project is a new $1 Billion hospital and medical campus for Inova which would replace nearby Alexandria Hospital and employ roughly 2,000 health care workers. The $2 billion proposal also calls for affordable housing, outdoor parks, a new fire station, and a transit hub that would anchor the city’s proposed bus rapid transit network, DASH, and Metrobus. Construction at the site could begin as soon as 2023, with the first buildings potentially opening in 2025.

CaroMont Health Kicks Off Construction for New Hospital, Medical Campus in Belmont (N.C.)

The CaroMont Regional Medical Center – Belmont is set to open in mid-2023. On 28 acres, the campus will include a 66-bed hospital, 16-room emergency department, labor and delivery unit, operating rooms and surgical capabilities, and diagnostic testing and imaging services. A medical office building and parking deck are also part of the plan. Estimates show the hospital could take as many as 16,000 patients in the first year and, in addition, create 150 new jobs. The project will also offer educational opportunities for students in Belmont Abbey College’s health science programs.

Hospital Chain Will Lease Part of Former Toys “R” Us in Eatontown, New Jersey

Edison-based Hackensack Meridian Health has committed to 45,600 square feet for an outpatient facility and urgent care center serving Central New Jersey at the Monmouth Plaza shopping center located at 133-137 Highway 35 in Eatontown, New Jersey. The new Hackensack Meridian location, slated to open in the second quarter of 2022, was cobbled together from the 80,592-square-foot shopping center’s closed Eastern Mountain Sports and DSW stores and a portion of a closed Toys “R” Us.

Real Estate Economy Trends

Prices Rise Faster Than Expected in June for Both Consumers and Businesses

Federal Reserve Chairman Jerome Powell continued to emphasize that inflation is transitory during his testimony to the House Financial Services Committee last week. However, he also admitted that inflationary effects have been larger and more persistent than expected. While there are signs that current inflation pressures are generally tied to the aftermath of the pandemic, longer-run forces might shift the economic landscape and merit some consideration. Powell’s testimony came a day after the Bureau of Labor Statistics released its consumer price index report for June, which showed the headline figure growing by 0.9 percent — the highest month-over-month number in 13 years. Combined with the previous three months, when the consumer price index grew by at least half a percentage point each month, inflation has grown by 2.9 percent over the past four months — an annualized rate of 8.7 percent. The less-volatile core inflation index, which excludes food and energy, also grew by 0.9 percent in June.

Pinnacle Real Estate Group Assessment

The Inflation Factor in Healthcare Real Estate

There continues to be more than the usual amount very large real estate transactions, hundreds of millions to more than billions of dollars, within the healthcare industry the past few months at unprecedented market terms which has generally accelerated, if not inflated, the values. As indicated in last month’s newsletter Assessment, we believe this trend will continue through the end of the year or until the expected pending inflation begins to become a reality. With the recent information shared by Federal Reserve Chairman Jerome Powell and Bureau of Labor Statistics released its consumer price index report for June, mentioned above, it seems that inflation is a foregone conclusion, and the last remaining question is, when will it, inflation, start effecting the markets, including healthcare? The current aggressive healthcare real estate market seems like a frenzy before inflation hits, which there are indications that has factored into the current situation. Because of that, our current assessment is that this aggressive trend, specifically in the healthcare real estate market and somewhat created by the perception of pending inflation, will continue for the foreseeable future and beyond any potential impact of inflation. The reason being the momentum the healthcare real estate market has established the past year combined with the reaction to the country and world reopening after the Pandemic should maintain the path regardless of potential inflation effects.

Christopher Louis, ASA, MAI

Director

720-598-1439

CLouis@AskPHC.comMike Vandaveer

Director

720-599-7883

MVandaveer@AskPHC.comTony Price

Continue reading →

Analyst

720-386-3540

TPrice@AskPHC.com